Smartly Payroll is the Xero alternative that offers seamless payroll processing with automated payments, specialised support, and easy integration with Xero accounting, all backed by a dedicated Kiwi helpdesk and onboarding team.

We understand that sometimes you just need to talk to someone who knows the ins and outs of payroll. Our Kiwi-based team of payroll specialists are just a call or email away, Monday to Friday, 8am to 6pm, with average phone wait times of 5 minutes or less. Plus our online Help Centre is packed with step-by-step guides and resources to get you started.

At the click of a button your payroll is sorted! Simply ‘process payroll’ – and we handle the rest. All your payments: to staff, IRD (PAYE and payday filing), KiwiSaver, student loans, child support and more are automatically sorted. You’ll spend less time loading bank files and manually sorting payments and more time working on your business.

Our thorough onboarding process means we’ll help identify issues of potential non-compliance from day one. We assist with data extraction and accurate leave balance calculations, reducing compliance risks and helping you pay your staff correctly. With Smartly, you'll never be left to figure it out on your own.

Designed by Kiwis for Kiwis, our software seamlessly integrates with Xero accounting, offering a dedicated payroll solution tailored to New Zealand's unique requirements. We continually update our specialised payroll software to meet the evolving demands of payroll and legislation, giving you confidence in your payroll and compliance processes.

Handover all the complex payroll admin to our team of payroll specialists. Your dedicated account manager will work directly with you to set up a payroll process tailored for your business needs and requirements. Our account managers will stay on top of any new legislation changes, like tax and minimum wage change for you.

*This information was gathered from online sources on the date of February 2025

Not at all. You can choose between a DIY setup or a managed onboarding option — where our team handles the heavy lifting. Most accountants and bookkeepers say the switch is smooth and supported from day one.

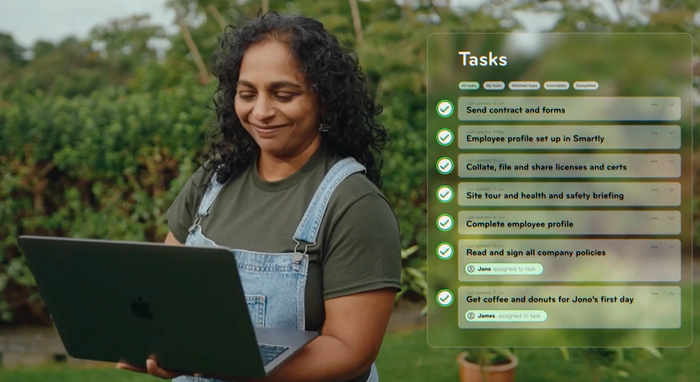

We start with a call to understand your payroll needs, then guide you through either uploading your data or letting us migrate it for you. Once you're set up, we provide training and support until you're confident using Smartly.

DIY means you load employee details and leave balances yourself (with our templates and guidance). Managed onboarding is more hands-off — we extract and convert your data from Xero and do it for you.

Yes — but it's a one-off fee and many partners and customers find the time savings and accuracy well worth it.

Yes! We integrate directly, and soon we’ll also support leave liability journals to Xero per pay run — something accountants have been asking for.

All Smartly customers get access to our NZ-based Helpdesk, which has an average response time of under 3 minutes. For our accounting and bookkeeping partners, you'll have access to an Account Manager, as well as our dedicated Partner Success team. Reach out to your Account Manager if you need the details.

Yes! Our Partner Portal (umbrella login) lets you manage multiple client payrolls with a single login, switch between clients, and access everything easily.

With recent Xero pricing changes, Smartly is often more affordable — especially if you have more than a few staff or need more payroll-specific features.

Product Compliance Lead at Datacom and creator of Smartly, Chris Mar, talks about what you should consider when choosing a payroll provider.

Good payroll software assists you throughout the entire payroll process from gathering inputs, automating the tax and net amount calculations and direct crediting employees and the tax department.

Using a payroll system that is automatically updated and helps keep you up to date with any changes to legislation such as, the Holidays Act, PAYE and new payday filing requirements is a must to remain compliant and avoid any unexpected penalties.

It's fair to say that the New Zealand Holidays Act is like no where else. And the complex rules to calculate entitlements and rates of pay are very unique to the NZ landscape. Which is why it’s so important to know that you’re choosing a payroll software that understands NZ legislation.

Payroll is an extremely complex subject and it can be a daunting task to try and figure it all out on your own. Whether you want to talk through the latest tax changes or you need help setting up new employees having the support you need is vital to remaining compliant.

Payroll is hard enough without also having to figure out how to use non-intuitive software. If your software is too hard to use the chances of you making a mistake increase significantly and therefore the chances of you becoming non-compliant increase also which is why it’s so important that you are able to run your pays and set up your business with ease.

Payroll is full of your employee’s sensitive information so you should be sure to check how your information will be stored when choosing payroll software for your business and what practises and standards are in place to keep your data safe and secure.