The Holidays Act 2003 is a very complex piece of legislation and one of the significant issues with leave calculations stems from Section 16 which states:

“After the end of each completed 12 months of continuous employment, an employee is entitled to not less than 4 weeks’ paid annual holidays.”

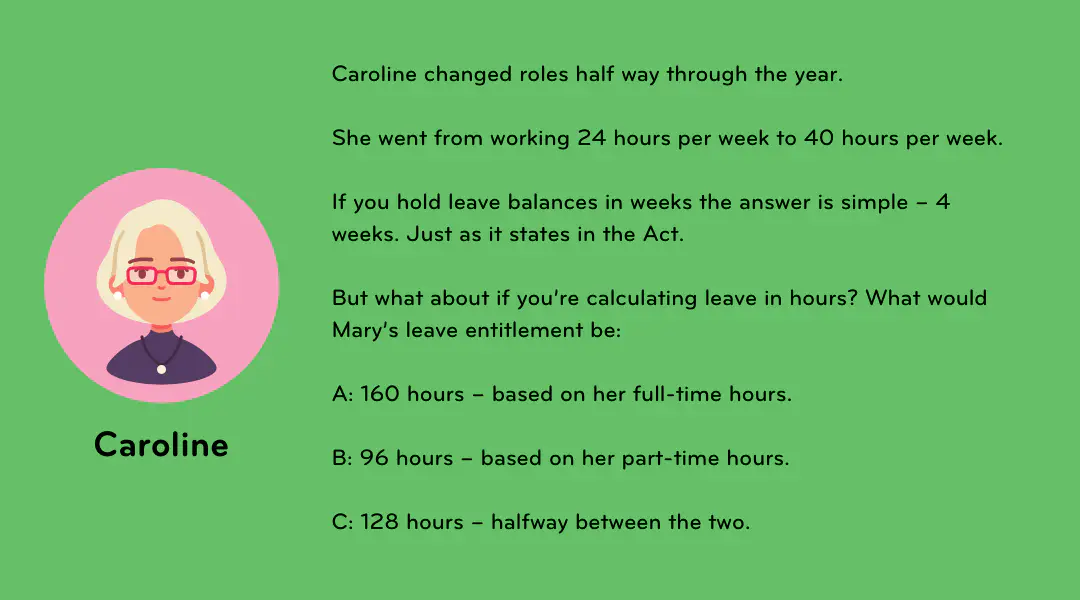

Sounds straightforward right? In other words, “employees get 4-weeks holiday pay”. Unfortunately, it’s not that easy. Most payroll systems record annual leave in hours and what starts out as simple math can quickly morph into something far more complicated. Most affected are employers with staff that work highly variable hours and days or who have changes in work patterns.

The easiest way to demonstrate compliance is to hold leave balances in the time units stated in the legislation – i.e. weeks.

.png)

.png/_jcr_content/renditions/optimized.webp)

.png/_jcr_content/renditions/optimized.webp)