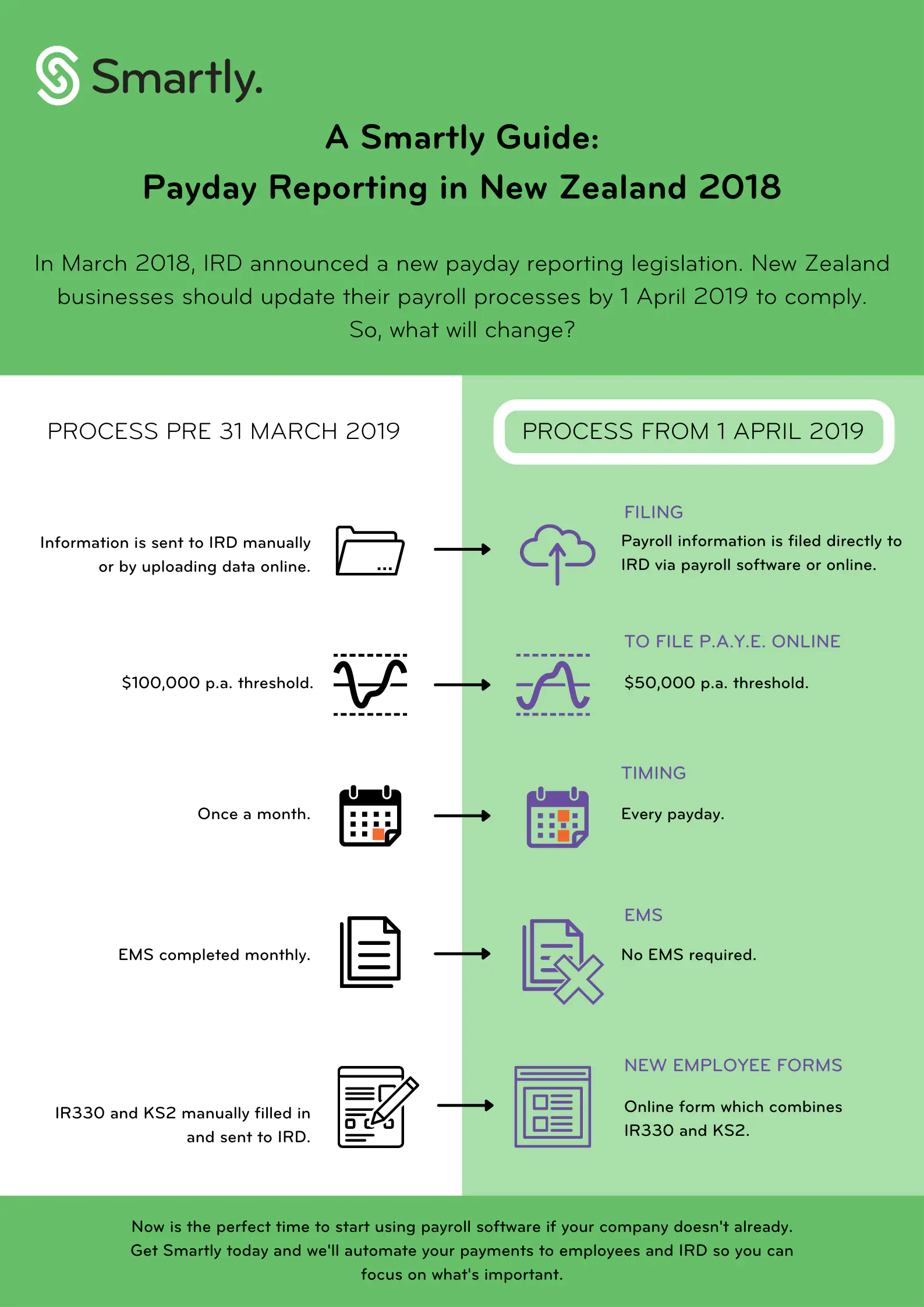

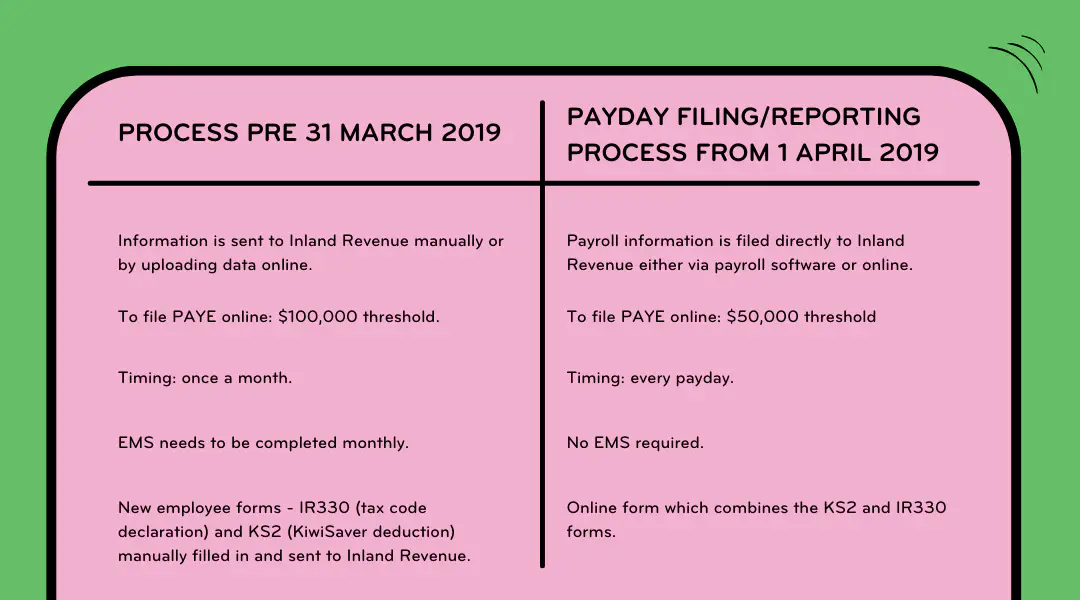

The new payroll legislation changes have made payday filing every payday compulsory for all employers from 1 April 2019. Employers who have staff on weekly or fortnightly pay schedules now have to do this filing on a weekly or fortnightly basis. Payday filing will give Inland Revenue information on the day the payments are made, ensuring their systems are as up to date as possible.

Payday filing requires the employer to complete an online form, which provides Inland Revenue with the following information:

- The pay details of your employees and pay cycle

- Information on new and departing employees; start/end date, contact details and date of birth – this should be filed before the employees’ first payday

Employers are able to correct employment information online, rather than completing an employer monthly schedule amendments form (IR344). Inland Revenue still won’t be able to accept negative adjustments. To make entering the correct information easier for employers when new employees are hired, paper IR330 and KiwiSaver deduction forms for new employees are also accessible online.

Depending on your annual PAYE and ESCT deductions amount, employers either need to file electronically or by paper.

- File electronically if these deductions are $50,000 or more. This will need to be filed within two working days after the employees’ payday

*Anyone who files their PAYE as an IR56 taxpayer will have 10 working days after payday to file the required information.

- File by paper if these deductions are below $50,000. Employers filing by paper will have 10 working days following payday or the 15th of each month (if the information is sent twice a month).

.png)