Paying staff bonuses can be a great way to incentivize your employees. However, it adds some extra steps into your payroll process!

Employee bonuses and staff allowances are both payments that you can add to your staff’s regular wages. This could be in exchange for hitting targets, as a new employee signing incentive, or around holidays like Christmas.

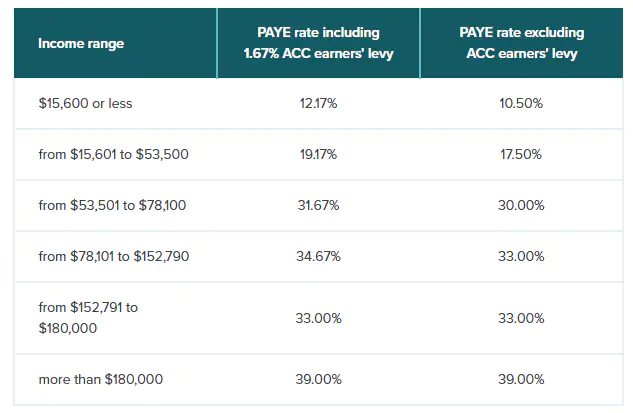

This article will explain what staff bonuses and allowances are, how to reimburse allowances, what tax you need to pay on staff bonuses, and how to run bonuses through payroll software.