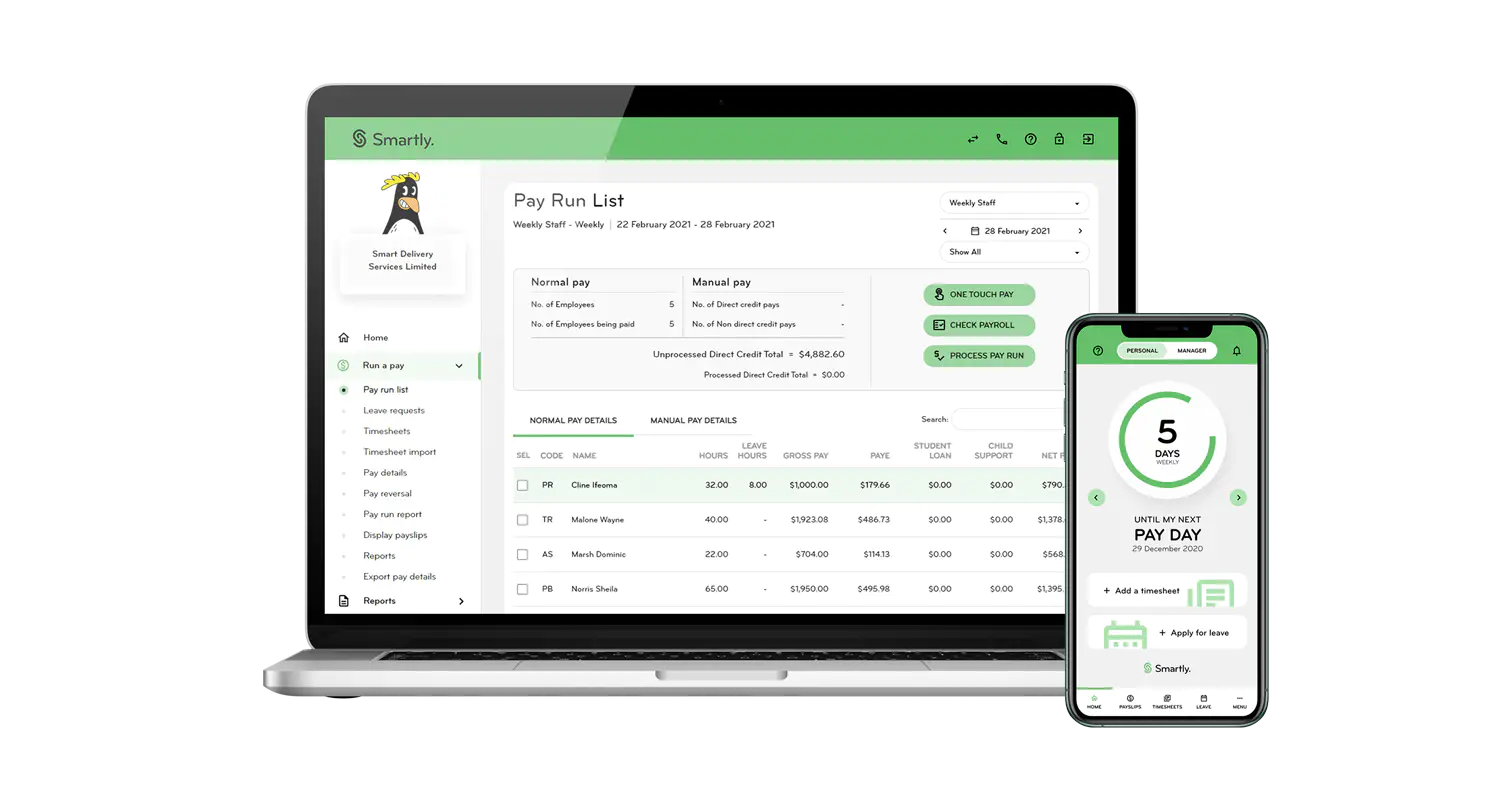

Payroll needs to be processed correctly every single time.

Not only is this a duty of care to your employees, it is your legal responsibility as a business.

Firstly, correcting payroll mistakes before payslips go out will lead to better employee satisfaction.

Hard working employees deserve to be fairly compensated, and processing payroll efficiently helps you do this. Ensuring you have a system for timesheets and tax code calculations will make this a much easier job for you.

Secondly, you are legally required to process payroll correctly.

Although employees should keep their timesheets up to date, payroll errors could still lead to penalties in your business. As the employer, you are responsible for your employees’ individual tax obligations. Ideally a payroll process should create payslips that shows automatically calculated leave, public holidays and tax deductions according to correct tax code brackets as well as their hourly wage.

To help you keep employees and the IRD happy, we’ve got you covered with how to avoid some common payroll mistakes below.