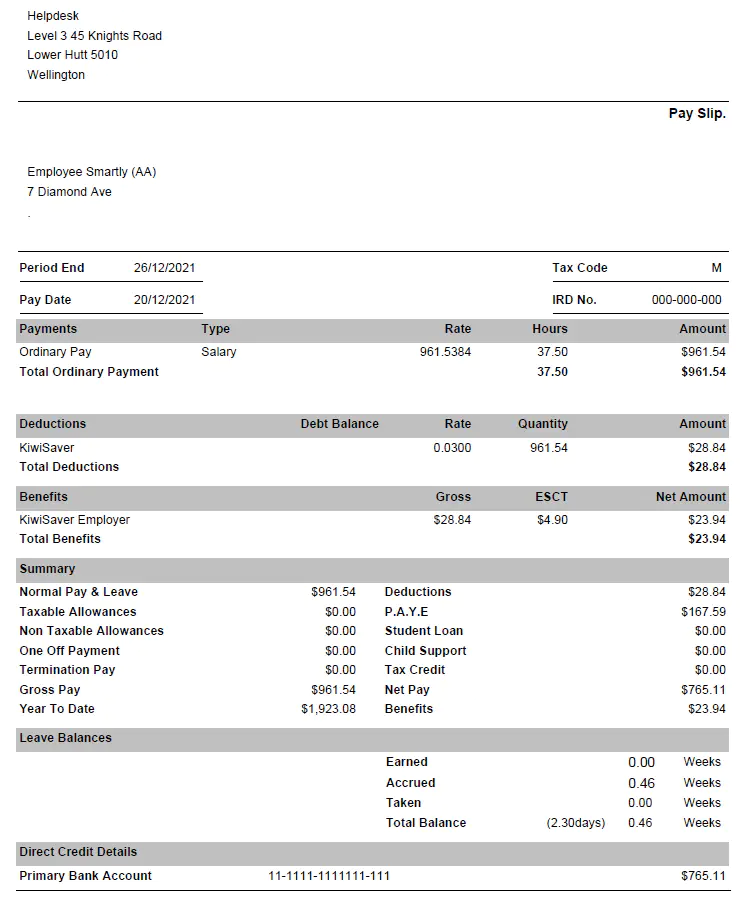

In New Zealand, the employee has the legal right to see information about how their employer has worked out wages and see the time records relating to their hours of work. Generating payslips from an online payroll wage system, where staff can get them each pay run through a mobile app, or automatically by email is an easy and efficient way to provide this information.

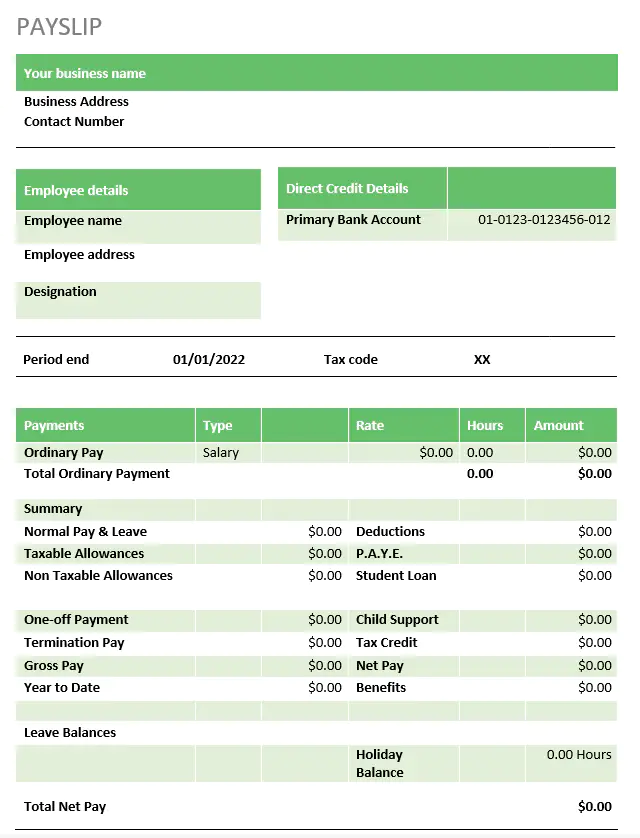

Creating a payslip template that suits your business from scratch can be tricky. If you are just wanting a simple editable document where you can manually enter in amounts for each individual employee, then this template will help you out.

.png)