Productivity tips for your payroll team

Payroll can be very challenging when trying to keep up with different business needs and constantly changing payroll legislation. When it comes to payroll processing, mistakes should be kept to a minimum. If it happens often, perhaps it is time to review your internal processes or your payroll team’s productivity.

Payroll errors are not well tolerated by staff who aren’t paid correctly, and it has flow-on effects for your tax compliance.

Fortunately, the nature of payroll makes it well suited to be streamlined with a few good productivity tips.

Being productive in the workplace

In a small business in particular, staying productive can mean staying afloat. Time is money, after all.

The longer it takes you to complete business admin, the more expensive it is, and the less time you have to focus on the core running of your business.

Productivity management in organisations of all sizes is important, but it’s especially so in small businesses.

Reasons behind an unproductive team

When tasks take longer than they should, it often boils down to a combination of a few key things:

Not knowing what work to prioritise

If staff don’t know a task is urgent, they can easily start working on something else. An urgent piece of work is easily held up when people don’t realise it needs to be completed before something routine.

Having trouble saying no even when their workload is full

Sometimes, it’s easier for someone to accept a new task than to point out that their plate is already full. It may be faster to assign that task to someone else, rather than have it wait in a queue.

Feeling overwhelmed with too many tasks

Some people work well under stress, and others don’t. A long to-do list can easily create a mental block and make it hard for people to produce their best work. They may make mistakes that take time to be undone, further impacting productivity and snowballing the feeling of stress.

Procrastinating

Staff that are easily distracted, or don’t understand the timeline on a piece of work can easily miss deadlines.

Always being in reactive mode due to an unclear strategy

When strategic priorities aren’t communicated, teams may not fully comprehend business critical tasks. They can be pushed and pulled between different pieces of work, taking time to familiarise themselves with the background and dragging out the time it takes to get things done.

Payroll: An important element of company culture

People want to be paid correctly at work. This really goes without saying.

They have their own bills to pay and lives to live, and an error-prone payroll system can create serious issues in the personal lives of employees. It’s completely understandable for staff to quit in favour of a job that pays them properly.

Not only that, but a business that makes mistakes in basic elements of its administration is hardly inspiring for staff. It would be hypocritical for a business that doesn’t pay staff correctly to expect a higher standard of work from them.

There isn’t necessarily much to gain by doing payroll correctly, but there is plenty to lose by getting it wrong.

Effectively managing your payroll process

When looking for ways to stay productive in payroll, include these processes in your system:

Use a payroll calendar

Payroll calendars set expectations for staff around when they’ll be paid and when their timesheets are due. It also helps payroll teams to understand deadlines for different tasks in order to keep pay cycles regular.

Train your HR staff for payroll

Payroll duties often fall to HR staff, but this isn’t a core part of their role. They’re likely to be more experienced in recruitment and managing company culture.

If HR staff are expected to manage your company payroll, giving them a thorough induction will help them to be more efficient.

Introduce automation in payroll process

Automating payroll tasks can reduce the manual effort your staff has to make. Allowing them more time to be productive in other areas of their jobs. Automation does it for them. It’s that simple.

Create transparency in payroll process to avoid misunderstandings

Payslips are often seen as unnecessary, but they help to break down what people are paid so they understand the process much better.

Transparency includes being open about how salaries are determined, how the payroll process works, procedures for correcting payroll errors and employee responsibilities.

Be up to date with tax procedures

Business tax obligations can change as you grow, and incoming government policies also have an impact. It’s vital business owners understand how these changes impact your tax status.

Integrate payroll with a workforce management system

Collecting timesheets and entering data into payroll systems takes time and is error prone. When payroll is integrated with your workforce management system, staff hours are automatically collected and payments flow on accordingly.

Create regular audits

When you don’t audit your payroll system, small mistakes become compounded over time. Recognising errors and opportunities for further efficiencies help to optimise your payroll system and ensure compliance.

5 productivity tips for your payroll team

There are many ways to improve productivity, these tips are best suited for people working in payroll.

1. Identify time consuming tasks

The tasks that take the longest to complete represent the biggest opportunity for efficiency gains. If you can streamline those tasks, you’ll have the biggest impact on your bottom line.

Conversely, look for simple tasks that are repeated often, and are time-consuming as a result. These might be simpler to streamline or automate, creating equally sizeable benefits.

2. Prioritise tasks from high to low

Prioritisation is key to effectively managing tasks, particularly if your payroll staff have other areas of responsibility.

One of the best ways to prioritise payroll tasks effectively is sticking to a schedule. Start from payday and work backwards to ensure your payroll is processed as it should be so that staff are paid on time.

3. Identify and review your team’s workload regularly

Burned out staff are inefficient, and this is a particularly concerning issue if it creeps into your payroll. Understand what goes into managing your payroll and look to hire additional resources if staff are maxed out.

4. Consider alternative processes

Sometimes implementing work efficiency tips means redesigning the way you do things. If a process isn’t fit for purpose, you may need to be brave and go back to the drawing board. This is a standard process in businesses that outgrow legacy systems.

Ask yourself, is there a better way of doing things? Consult payroll staff themselves - they’re the ones who are at the coalface, and if they have previous experience managing payroll then they may have ideas.

5. Create an accountability culture in your team

Accountability is about empowering people to take responsibility for the way things are done. Encourage people to look for efficiencies in their work, and be willing to take their recommendations when they want to change things up. You can even incentivise it.

Having accountability not only keeps staff on task, it motivates them to do better.

Take home message

Business owners that see payroll as unappealing are often reluctant to get involved in it. They prefer to keep it at arm’s length and just not get involved.

At the same time, payroll staff may prefer just to stick with the way things are done, even if it’s not overly efficient.

Both of these approaches cost businesses time and money. The goal of payroll is simple, which is one of the reasons why it’s well suited to being streamlined with specialist software.

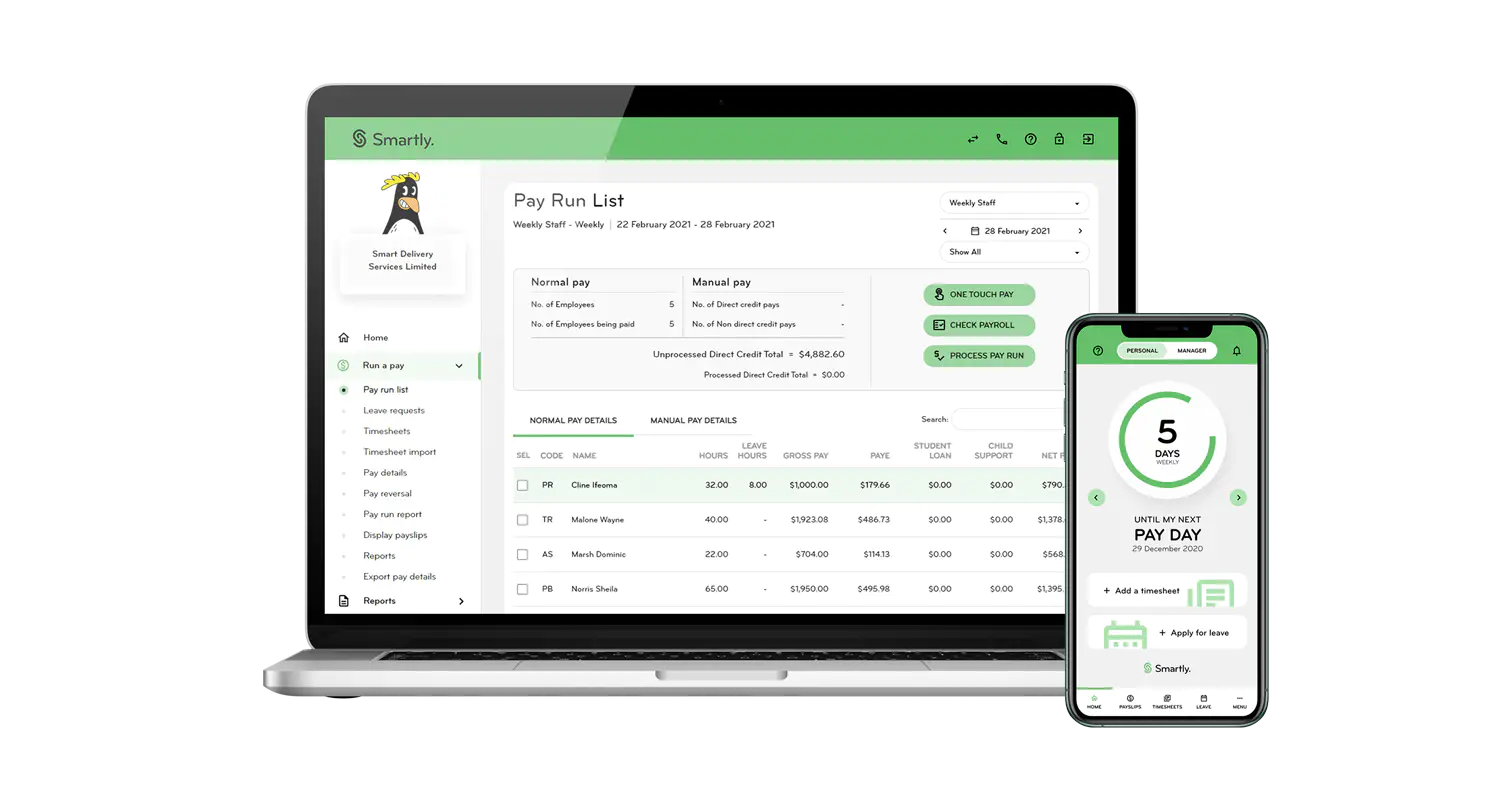

This is where Smartly comes in. Take the headache out of your payroll system and make it easy to pay your people on time, accurately and reliably.

Not using Smartly yet?

If you want to learn more about how your day-to-day tasks can be made simpler, you can chat to us to get some insight on how payroll software could benefit your business. Smartly can make the complex tasks seem simple including payroll, timesheets, leave and more! Smartly takes care of most of the faffing, so you can focus on the important stuff.