ACC

If an employee has an injury covered by ACC, there is a one week stand down period from their DOFI (Date of First Incapacity). If DOFI occurs in the middle of a working week, the employees first week of ACC may need to be split over two pay periods. ACC pays the employee from the second week.

If the injury was work related, the employer pays the employee during the first week at 80% of what they would normally receive. This is not paid from their leave, it is paid as wages.

You can set up an allowance for this with the rate for the allowance set at 80% of the normal hourly rate. Then simply enter the quantity of required hours at pay time. See below for instructions on how to do this. Sometimes the first week period falls over two pay periods so it is better to be able to enter hours at pay time.

To record the time your employee was away, you would set up a special leave call ACC. This leave is not used to pay the employee, but to simply record the hours so the employee's annual leave can accrue accurately.

The employer should be able to sight a claim form or reference from a doctor confirming there is an ACC claim.

If the injury was not work related, the first week can be covered by either sick leave or annual leave. If the employee doesn't have sick leave or annual leave, it should be recorded as leave without pay.

ACC earner levy

The ACC earner levy rate will increase from $1.60 to $1.67 for every $100 of liable earnings from 1 April 2025.

The maximum liable earnings threshold will also increase from $142,283 to $152,790 for the 2025/2026 tax year (Maximum levy payable will be $2,551.59).

The minimum liable earnings that self-employed people pay Work and Earners' levies on will increase to $49,365.

Smartly will automatically update the ACC Earners' Levy rates for you.

How does this affect my employees?

If your employee receives the same gross amount every pay run, they may notice a slightly lower net amount after 1 April. This is because for every $100 they are paid, they now need to pay 7 cents more in ACC levy. Please note in Smartly, ACC is incorporated into the PAYE when you are making a normal pay.

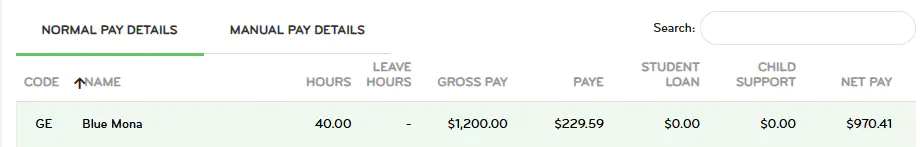

Example of an employee's pay before April 2025:

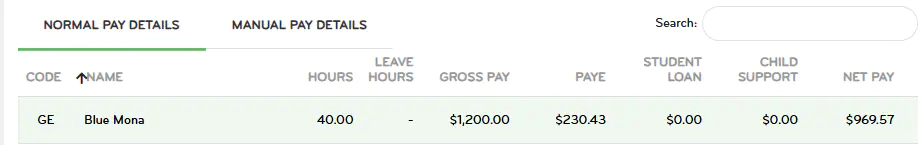

Example of an employee's pay after April 2025:

Setting up an employee on first week ACC

Follow the steps below to set up an employee on ACC and pay the first week at 80% if the injury is work related.

1. Go to Settings > Payroll settings > Pay components.

2. You should see 1st Week ACC is already set up under Allowances. The 'Taxable' box and the 'Include in base for KiwiSaver' box should be ticked on.

3. Click on Special Leave and click Add.

4. Type ACC into the description. Leave the 'Paid leave' box unticked and Save.

5. Go to Settings > Payroll settings > Contract groups and select the relevant group, e.g. salaried employees, waged employees.

6. Scroll down to the Special Leave section and tick on ACC.

7. Scroll down to the Allowances section, and tick 1st Week ACC.

8. Click Save.

9. Go to People > Click the arrow next to the employee's name.

10. Click on Payments.

11. Scroll down to Special leave and tick on ACC.

12. Scroll down to Allowances, tick 1st Week ACC. Leave Quantity blank and enter 80% of the employee's rate under the Rate field. You can calculate this by multiplying their rate by 0.8. Eg, 30 x 0.8 = 24.

13. Click Save.

14. This will now be available to be paid under Pay, Run a pay.

Note: 1st Week ACC should always have an allowance line and an ACC special leave line.

Each week, after the first week, the employee's hours should be recorded as ACC special leave so they continue to accrue leave correctly.

For the employee's first week ACC:

1. Click on Pay > Run a pay and double click on the employee.

2. Select Add leave item and choose ACC. Enter the date range that the employee was away during that pay run. The hours should auto populate. Recording the ACC hours is important so that the employee continues to accrue leave correctly.

3. Under Allowances, click on the edit pencil next to 1st Week ACC. Enter in the hours that the employee was away in the Quantity box. The rate should be 80% of the employee's normal hourly rate.

4. Click Save.

For the employee's second week onwards ACC:

Follow Steps 1 and 2 above, and click Save.

ACC top-ups

Top-ups can be paid by the employer while ACC is paying the employee. This can only be 20% of their normal earnings (so they don’t exceed 100% while ACC is paying them 80%).

This would usually be paid from sick leave and is equal to 1 sick leave day paid per week of the employee being away (i.e. 1 day being 20% of a 5-day work week). If the employee has no sick leave left, they can choose to take their annual leave instead.

Sometimes employers choose to just pay the top-up themselves, i.e. as an extra payment to an employee, not from a leave balance. If the employer would like to pay it themselves, they can set up a taxable allowance and call it something like ACC top-up.

If an employee is receiving a top-up from their employer, they should check with IRD if they should be on a secondary tax code (they may need to complete a new IR330) as their ACC payment will be their main income.

To change an employee tax code, hover your mouse over People and then click Employee page. Double click into the employee, and under Bank & tax, change the tax code and then click Save. You do not need to send the completed IR330 form to IRD but you do need to save it with your business records.

Leave entitlements when an employee is off work and receiving ACC payments

Employees should get their full annual leave entitlements, and other leave entitlements (i.e. sick leave) as they are still considered to be in continuous employment.