Child support

Inland Revenue Child Support may send a notice to deduct, amend or stop child support payments from your employee’s pay.

The notice shows:

- Your employee’s name and IRD number.

- The payday that you must start, amend or stop child support deductions.

- The amount to deduct from each pay.

- Employee reference number (currently only for MSD/ACC).

- If this is the first time you are making deductions, don’t make any deductions before the start date on the notice.

- All employees who have a change to their child support amount in the upcoming pay period.

In situations where the employee has one or more attachment orders in addition to a child support notice, the child support payment should always be deducted ahead of any other attachment orders.

The following order of rank should apply:

- Child support

- Other attachment orders

- ACC levy

- Student loan repayments

- Kiwisaver employee contribution

- Other voluntary deductions

Note: ACC levy is excluded when calculating protected net earnings on attachment orders.

How to enter a child support notice and future dated child support changes

Note: You don’t need to wait for the correct pay period to enter a child support notice or amendment. You can enter it as soon as you receive it and simply enter the date that the new payment becomes effective.

1. Log into your site and go to People.

2. Click the arrow next to the employee.

3. Select the Bank & Tax section.

4. Under Child Support, tick the box and enter the amount.

If you need to update or correct the payment before the payment is made, select a new start date for the updated payment and the amount.

If you receive notice of a change to child support payments, you can enter the new amount with a date in the future that matches the child support notice.

5. Click Save.

Scenario

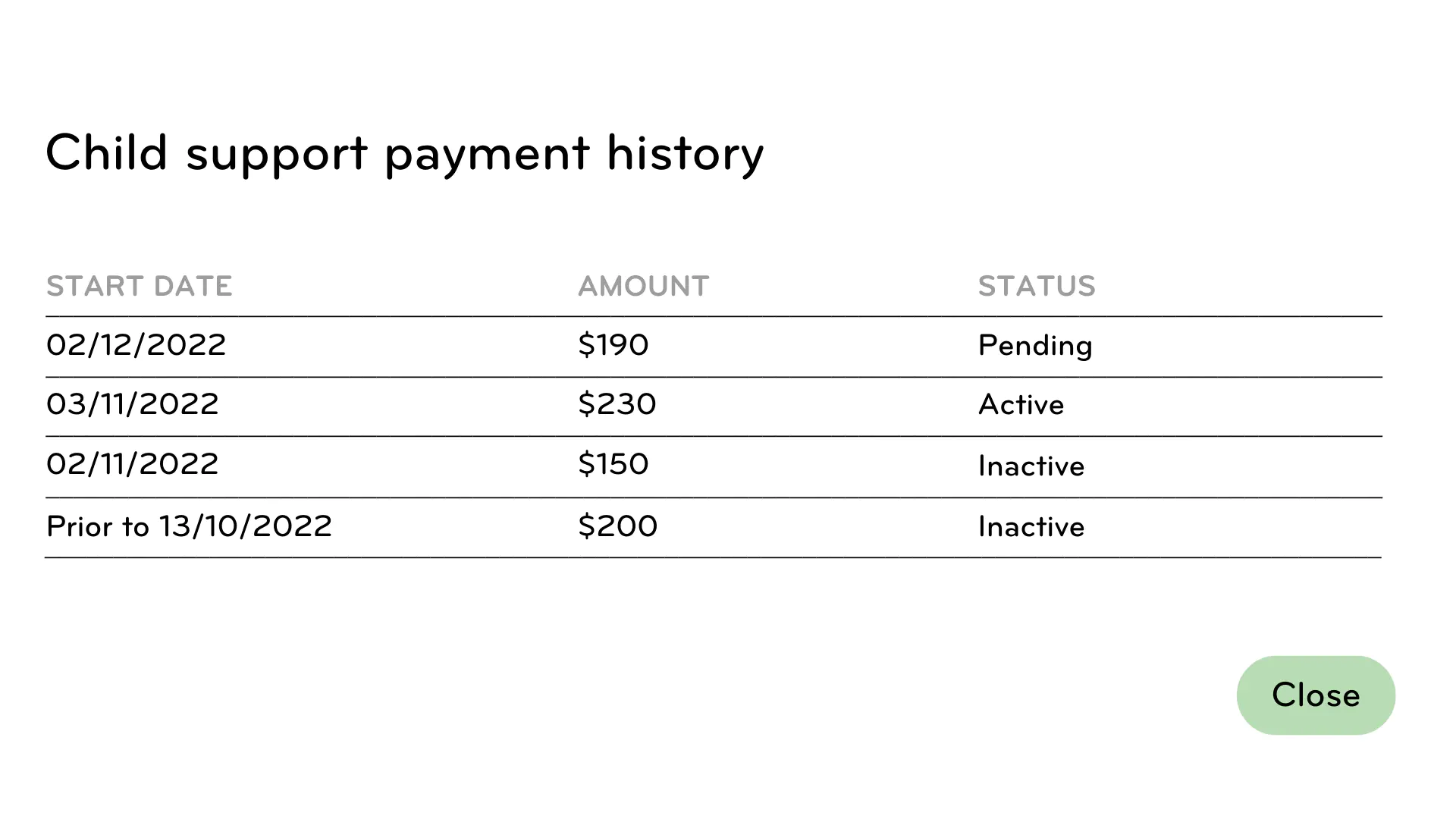

You have a Child Support payment set for $230 going out. When you create a new future child support payment for $190 starting on a new payment date, you will be able to see the payment history like in the example below.

Each payment in the payment history will have a status:

- Pending – the start date is in a future pay period.

- Active – the start date is on or before the current pay period and the feature is enabled.

- Inactive – the child support rate was paid, and the feature has either been turned off or a new “Active” payment exists.

Note: The system will only hold one pending (future dated) payment so if a second future dated payment is created, it will overwrite the first. You can use this method to correct any errors before the payment goes out.

Protected net earnings

All employees must be allowed to keep 60% of their net pay, after tax and child support and any other attachment order is deducted. This is the employee’s ‘protected net earnings’, to cover living expenses. Note that student loan repayment obligations are not considered a tax when calculating protected net earnings.

‘Protected net earnings’ only apply to child support payments (and other attachment orders as described in the following section). You must still make other deductions, such as student loan repayments, KiwiSaver or ACC Earners’ Levy. However, insurance, superannuation and union fees may be deducted subject to the Wages Protection Act 1983. Child support and any other attachment order deductions cannot exceed 40% of the net pay.

You can view more about protected net earnings from IRD's website.