KiwiSaver

KiwiSaver for new employees

New employees should be automatically enrolled into KiwiSaver if they are

· eligible to be enrolled

· aged between 18 and 65

The rate you deduct employee contributions from their gross pay is 3%, 4%, 6%, 8% or 10%. The employee tells you which rate to use on their KiwiSaver deduction form – KS2 (available on the IRD website).

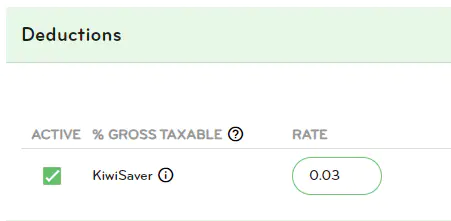

KiwiSaver deductions on your Smartly site are entered as per below example. A deduction of 3% for an employee is entered as 0.03. If the employee deductions is to be 10% it would be entered as 0.1

If the employee does not choose a contribution rate, use the default rate of 3%.

Employers must contribute a minimum of 3% of their employee’s gross salary or wages to their KiwiSaver. Employers must make these payments every payday. This is in addition to the employee’s gross salary or wages.

If the employee would like to opt out of KiwiSaver, they can fill in a new employee opt-out request form - KS10 (available on the IRD website).

How to opt an employee into KiwiSaver

1. Go to People.

2. Click on the arrow next to the employee's name.

3. Click on Bank and tax.

4. Scroll down to the KiwiSaver informtion section and select the relevant Opting In option under Status.

5. Click Save.

6. Go to Payments.

7. Scroll down to the Deductions section and enter the amount the employee wants to contribute to KiwiSaver.

8. In the Benefits section, enter the rate your company would like to contribute to the employees KiwiSaver fund, or you can tick the box to use the minimum compulsory rate.

9. Click Save.

How to opt an employee out of KiwiSaver

New employees you've automatically enrolled into KiwiSaver can ask you to opt them out between 2-8 weeks of starting work. Employees who've opted into KiwiSaver cannot opt out later.

To opt out, your employees must fill out a KiwiSaver opt out request, KS10. You must send this form to IRD once your employees have filled it out.

Any late opt out requests (after 8 weeks) must be approved by IRD first.

To opt an employee out of KiwiSaver in Smartly:

1. Go to People.

2. Click the arrow next to the employee's name.

3. Click on Bank and tax.

4. Scroll down to the KiwiSaver information section and select Opting Out under Status.

5. Enter the employees opt out date.

6. Enter the employees bank account name and number they would like their refund credited to.

7. Select an option for the Late Opt Out Reason.

8. Click Save.

For more information about employees opting out of KiwiSaver, please visit the IRD website.

Opted into KiwiSaver in error

If you have an employee that was opted into KiwiSaver in error, follow the steps below.

1. Go to People.

2. Click on the arrow next to the employee's name.

3. Click on Bank and tax.

4. Go to the KiwiSaver information section and select opting out under Status.

5. Enter the employees opt out date.

6. Enter the employees bank account name and number they would like their refund credited to.

7. Select did not meet the criteria to join KiwiSaver (see Employee information pack [KS3] for criteria) for the Late Opt Out Reason.

8. Click Save.

How to change the KiwiSaver deduction rate for an employee

1. Go to People.

2. Click the arrow next to the employee's name.

3. Click on Payments.

4. Scroll down to the Deductions section and enter the amount the employee wants to contribute to KiwiSaver.

5. Click Save.

Salary sacrifice

If you have a new employee and their contract states the KiwiSaver employer contribution is included in their salary/rate, you will need to reduce the employee's total salary/rate by the amount of the KiwiSaver employer contribution and then tax this contribution under the ESCT rules. This is the only option available in Smartly.

IRD states the tax on this contribution can be deducted in two ways:

- You deduct ESCT from each employer contribution.

- Your employer contribution is included in your employees' gross salary or wage. Tax is deducted under the PAYE rules.

Note: Our system does not have the ability for the employer contributions to be taxed as salary and wages under the PAYE rules. This is because the arrangement is by agreement, not mandatory, and we have not had cause to offer this functionality because we have the ability to tax the superannuation employer contributions through the normal ESCT rules.

The amount sacrificed reduces the taxable income which determines the rate of PAYE paid, and the employee contributions. The employee contribution does not need to be on the pre-sacrificed level. Holiday rates are also calculated on the reduced amount. This is correct because rates are based on gross earnings as defined in the Holidays Act which specifically excludes any payment of any employer contribution to a superannuation scheme for the benefit of the employee (S14 (c) (iii)).

How to calculate the employee's salary/rate to enter in Smartly.

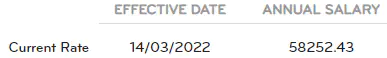

Example 1. Employee's total salary is $60,000 and the KiwiSaver employer contribution of 3% needs to be deducted from this.

$60,000 / 1.03 = $58,252.43

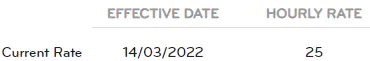

Example 2. Employee's total hourly rate is $26 and the KiwiSaver employer contribution of 4% needs to be deducted from this.

$26 / 1.04 = $25

The employee's salary/rate includes the KiwiSaver employer contribution and the 8% holiday pay

If their contract states both the KiwiSaver employer contribution and the 8% holiday pay is included in their salary/hourly rate, you will need to calculate these separately. If you take 11% off the total salary/rate, you will not end up with the correct figure.

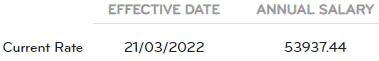

Example 1. Employee's total salary is $60,000 and the KiwiSaver employer contribution of 3% and the 8% holiday pay needs to be deducted from this.

$60,000 / 1.03 = $58,252.43

$58,252.43 / 1.08 = $53,937.44

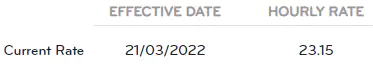

Example 2. Employee's total hourly rate is $26 and the KiwiSaver employer contribution of 4% and the 8% holiday pay needs to be deducted from this.

$26 / 1.04 = $25

$25 / 1.08 = $23.15

Employee is now over 65 but wants to stay in KiwiSaver

If the employee wants to continue to contribute to their KiwiSaver fund, they can still do this through payroll deductions. You as an employer, however, are no longer obligated to contribute, so you can turn off the Compulsory Employer Contribution.

We need to do this on our end, so please call us on 0800 10 10 38 or email helpdesk@smartly.co.nz and we will set this up for you.

Savings suspension

If your employee wants to take a break from paying into their KiwiSaver, they need to apply for a Savings suspension through their myIR.

IRD will send a suspension notice to you and your employee once they have approved the application. The suspension notice will have dates showing how long the suspension is for.

Once you receive the suspension notice you can apply it to your employee's profile settings in Smartly:

1. Go to People.

2. Click the arrow next to the employee's name.

3. Click Bank and tax.

4. Scroll down to the KiwiSaver information section and select the Savings suspension option under Status.

5. Click Save.

Note: Once the employees Savings suspension time comes to an end or they want to start their payments again, just change their KiwiSaver Status back to Opting In (Automatic enrolment) and their deductions along with the Employer contribution will start again.

For more information about Savings supsension and suspension notices, please visit the IRD website.

KiwiSaver Status definitions

Opting In (Automatic enrolment)

To be used for:

- New employees who have automatically been enrolled (i.e. new KiwiSaver members)

- Temporary employees who are being automatically enrolled after 28 days. These employees would be changing from option Exempt (Casual/Temp < 28 days)

- Casual agricultural employees (on tax code CAE) who are being automatically enrolled after 3 months

Not to be used for:

- Existing KiwiSaver members - See Opting In (Existing member)

- Anyone who opts in voluntarily - See Opting In (Voluntary enrolment)

Opting In (Existing Member)

New employees who are already in KiwiSaver.

Opting In (Voluntary enrolment)

To be used for eligible new and existing employees who choose to opt in. For example,

- Employees aged 65 and over who choose to opt in

- Temporary employees who choose to opt in within 28 days

- Casual employees who choose to opt in

Opting Out

To be used:

- To indicate an employee has already opted out of KiwiSaver when an employer has transferred to Smartly.

- For employees who were automatically enrolled and are choosing to opt out (employees cannot opt out within 2 weeks of their start date).

Opting Out (Over 65)

To be used for existing employees who are 65 years old or over who belonged to KiwiSaver and are opting out.

Savings Suspension

To be used when an opted in employee is on a KiwiSaver savings suspension.

Exempt

To be used for:

- Employees who are not eligible for KiwiSaver

- Employees who don’t need to be automatically enrolled and haven’t chosen to opt in

However, going forward this is not to be used for employees who fall into the categories for Exempt (Casual/Temp) or Exempt (Under 18).

Exempt (Casual/Temp employee)

To be used for:

- Casual employees who haven’t chosen to opt in

- Temporary employees employed for 28 days or less who do not need to be automatically enrolled into KiwiSaver, and who haven’t chosen to opt in.

Not to be used for:

- Casual agricultural workers (tax code CAE)

Exempt (Under 18)

To be used for employees who are exempt from KiwiSaver because they are under 18, and they have not opted in with their scheme provider.

KiwiSaver Late Opt Out Reason

This must be provided if the date of the opt out notice is signed by the employee 56 days or more after the employment start date.

The KiwiSaver Bank A/C and Bank Account Holder Name is that of the employee and will be the account that IRD process any refunds to.

If you select “Other reason (please explain)” you must provide a reason. This information is sent to IRD.

KiwiSaver Exempt Income Reason

For new employees only where applicable.

The KiwiSaver Exempt Income Reason should be set where is an expectation that the employee will receive KiwiSaver exempt earnings within their first 12 months of employment.

The field should only be completed for new employees, the status does not have to be retrospectively applied to existing employees.

In the event the employee will receive more than one type of KiwiSaver exempt income in that period then the reason associated to the income type with the greatest estimated overall value should be selected.

This is a simple indicator required so that IRD can see a potential reason for any undercalculation of KiwiSaver at the end of the tax year.

Note: IRD have provided this list of all possible reasons – there is no “Other” option. The field can be left blank.