Annual leave calculations

All permanent employees are entitled to 4 weeks of annual leave after working with the company for 12 months. Below are some common questions regarding annual leave and its calculations. To discuss your specific situation, please call us on 0800 10 10 38.

Earned leave vs Accrued leave

Earned leave: Leave that the employee is entitled to because they have reached their anniversary (either their 12 month employee anniversary or your specified company anniversary).

Accrued leave: Annual leave gained in the first year since the employee’s (or the company’s) anniversary date. Accrued leave is not necessarily available to be taken and the balance builds up each pay period until the employee passes their anniversary date. Once the anniversary date is passed the accrued balance of leave moves into the Earned column and the employee begins accruing again from zero.

Whether you allow employees to take Accrued leave or not is up to your company policy. Any accrued leave an employee takes is considered leave taken in advance, and the monetary value will be deducted from their final pay if the employee leaves the company before the leave becomes Earned leave.

How annual leave is accrued

Site with annual leave in weeks

If your Smartly site shows your employees' annual leave balance in weeks, the annual leave is accrued by:

Annual leave entitlement X Days in accruing period/Number of days in the year

For example, for an employee who is entitled to 4 weeks of annual leave a year and is paid weekly:

4 X 7/365 = 0.0767 weeks of accrued leave per pay period

If the above employee works 40 hours per week, 0.0767 X 40 = 3.068 hours of accrued leave per pay period.

Site with annual leave in hours

If your Smartly site shows your employees' annual leave balance in hours, the annual leave is accrued by:

Annual leave entitlement X Hours worked per week/Number of weeks or fortnights or months in a year (depending on pay frequency)

For example, for an employee who is entitled to 4 weeks of annual leave a year and is paid fortnightly:

4 X 40/26 = 6.1538 hours of accrued leave per pay period

Accruing leave while on leave

Why does my employee accrue leave while they are on leave?

According to Holidays Act Section 16, "After the end of each completed 12 months of continuous employment, an employee is entitled to not less than 4 weeks’ paid annual holidays." 12 months of continuous employment includes periods when employees are:

- on paid leave

- on parental leave

- on volunteers leave within the meaning of the Volunteers Employment Protection Act 1973

- receiving ACC payments

- on unpaid sick leave or unpaid bereavement leave or unpaid family violence leave

- on unpaid leave for any other reason for a period of no more than 1 week

For more information, please see Holidays Act Section 16.

Annual leave rate

A question we often get is an employee receives X dollars per hour, how come their annual leave is higher per hour than their hourly rate? By law, an employer has to pay an employee the greater amount of employee’s ordinary weekly pay or average weekly earnings when they go on annual leave.

Ordinary weekly pay (OWP) is the amount an employee receives under his or her employment agreement for an ordinary working week, including:

- regular allowances, such as a shift allowance

- regular productivity or incentive-based payments (including commission or piece rates)

- the cash value of board or lodgings

- regular overtime.

Average weekly earnings (AWE) are worked out by calculating the employee’s gross earnings over the 12 months prior to the end of the last payroll period before the annual holiday is taken, and dividing that figure by 52.

To see the leave rate explanation for a specific employee, click on the ? in the Add leave item screen (under Run a pay) once you have added your leave item.

For more information regarding ordinary weekly pay and average weekly earnings, please refer to the Employment NZ site.

Annual leave calculations at termination pay

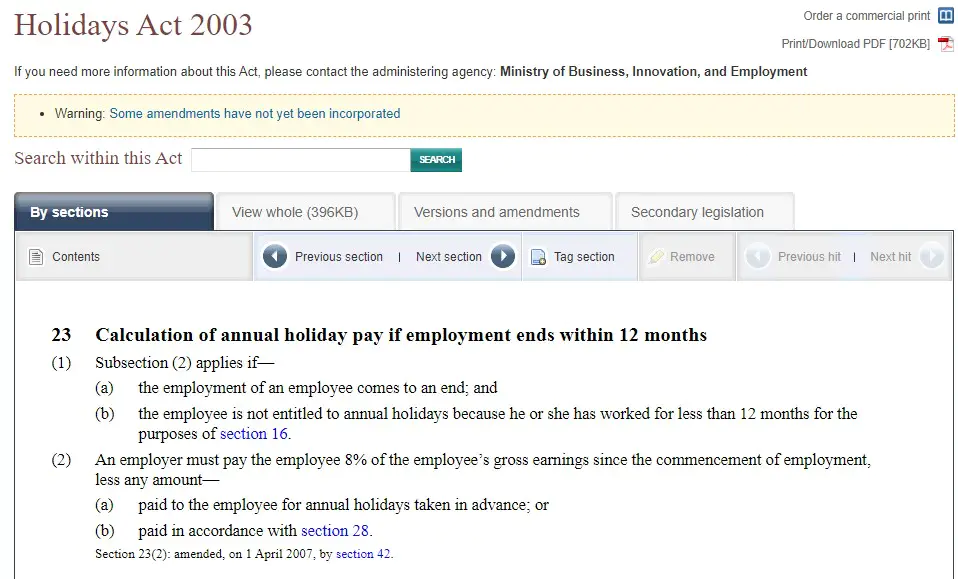

Termination pay for employees that have worked for less than 12 months

For employees who have worked less than 12 months:

- Employees should be paid 8% of their gross earnings since they started employment.

- Minus any annual leave that was taken in advance or paid on a pay-as-you-go basis.

- The employer will also have to pay out any contractual benefits owing.

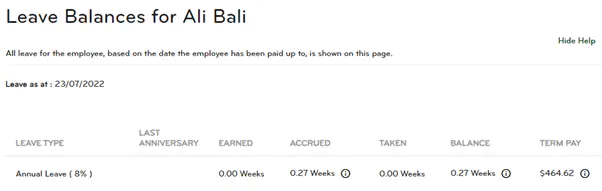

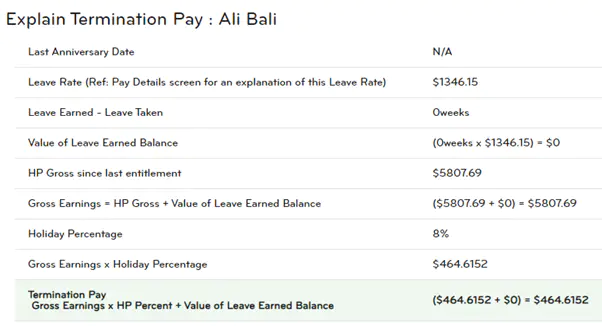

In the example below, employee Ali Bali has been working for the company for less than 12 months. His accrued leave is not taken into consideration for his final pay. He will be paid 8% of his gross earnings minus any leave he has taken in advance. As he has not taken any leave, his final pay is 8% of his gross earnings of $5,807.69 which equals $464.62.

You can view the breakdown of your employee's termination pay calculations when you click on the i next to the term pay figure under the relevant employee's Leave screen (People > Click the arrow next to the relevant employee > Leave).

Termination pay for employees that have worked for more than 12 months

There are two calculations to do to work out the annual holiday payments for these employees:

- The employee is paid for any remaining Earned leave. These are paid at the rate of the greater of ordinary weekly pay or average weekly earnings, as if the holidays were being taken at the end of the employment, plus

- The employee gets an annual holiday payment of 8% of their gross earnings since their last anniversary date for annual holidays. This includes other payments made in the final pay, minus any amount the employee has been paid for:

- annual holidays taken in advance

- annual holidays on a pay-as-you-go basis.

- The employer will also have to pay out any contractual benefits owing.

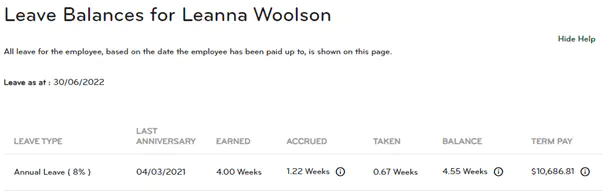

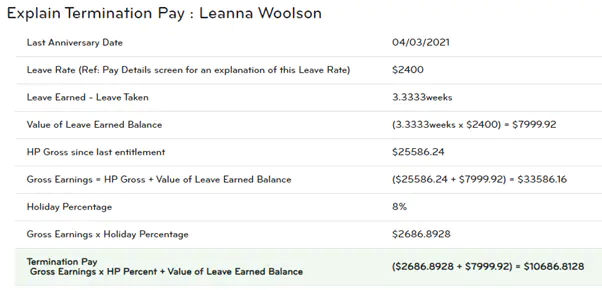

In the example below, employee Leanna Woolson has worked for the company for more than 12 months. The following calculations were made:

- Remaining Earned leave on annual leave rate: 3.3333 weeks X $2,400 = $7,999.92.

- 8% of gross earnings including other payments made in the final pay (eg. the Earned leave payment): 8% of (Gross Pay + Earned leave pay) = $2,686.8928

- Leanna didn't use any of her Accrued leave as she still had Earned leave left over so there were no leave taken in advance.

- Her final pay is her Earned leave payment + 8% = $7,999.92 + $2,686.8928 = $10,686.8128.

You can view the breakdown of your employee's termination pay calculations when you click on the i next to the term pay figure under Employee details > Leave balances.