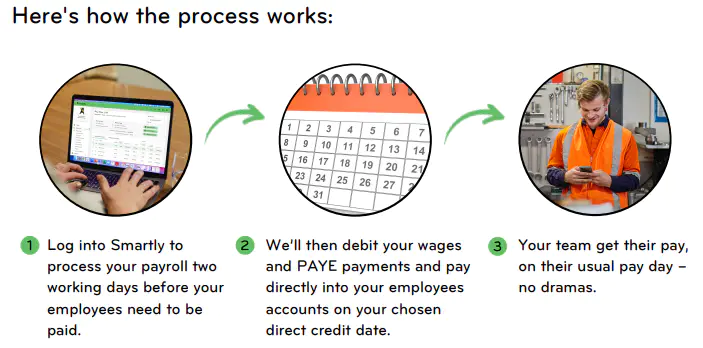

Direct debit processing

We have a Direct debit banking option for employers who bank with one of the smaller banks that do not offer Direct Banking. This means we can still look after the payments to your staff and to the IRD.

Once you have passed the eligibility criteria, we can get you started on this service.

The differences between this option and if you are on our fully automated service with ANZ, BNZ or Westpac are as follows:

- Once your payroll is processed, the gross payroll amount will be debited from your bank account two business days before your chosen direct credit date. Your payroll processing cut-off time will remain at 6pm

- Your payroll will only be processed if there are sufficient funds in your bank account. Previously, you have had a Letter of Credit in place, meaning that your payroll would be processed even if there weren't sufficient funds available

- Direct debit processing is only available through the Smartly web application and is not currently available through the employer app.

- Automated sending of payslips to employees isn't currently available for your bank, as we're unable to identify when the money has been successfully received into the employee’s accounts, only when it was processed out of our account. You can still send payslips to your employees by logging into Smartly on your direct credit date, or you can get your employees to check their payslips through the Smartly employee app

- If your direct debit payment dishonours, your payroll site will be locked and only released when the amount is paid in full by bank transfer. If the dishonoured amount remains unpaid for 5 working days, collection procedures will begin

We have put together a demo video for when you are running your first pay on Direct debit processing.

Processing your payroll

1. Log in to your Smartly site, and head to Pay > Run a pay.

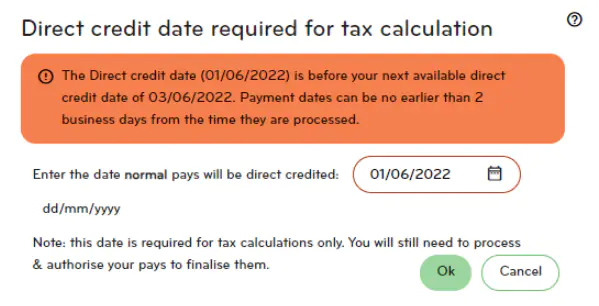

2. Enter the pays for your employees, along with any leave included in their pay period. When choosing your direct credit date, you'll only be able to select a date two or more working days from the current date. In this example, the direct credit date will be 3 June 2022.

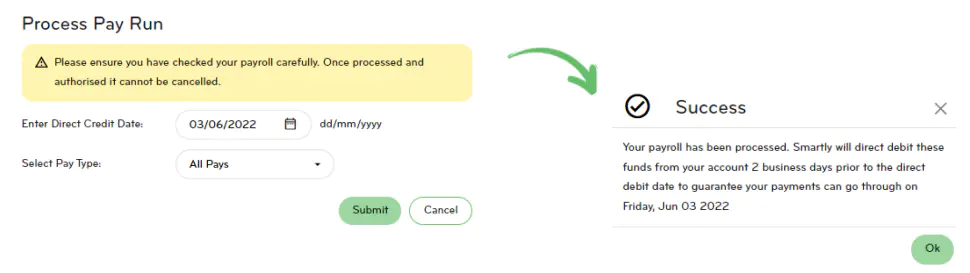

3. Once your pays are complete, click Process pay run. You'll be shown the message below, and once you click Submit, you'll see the 'Success' message.

Frequently asked questions

Can I process my pay at any time?

The direct credit date chosen must be at least 2 working days from today’s date, and the pay run must be closed during business hours, i.e. a work day before 6PM.

What happens if the direct debit dishonours before the direct credit date?

If your payroll dishonours before the direct credit date, we'll be notified and be in touch to let you know.

In this situation you can re-process the pay run for a new direct credit date (which will need to be another 2 business days in advance).

What time will the payroll amount be debited from my bank account?

The funds will be debited from your bank account within a few hours of processing the pay.

What time will my employees be paid on the direct credit date?

Your employees should receive their pay in the afternoon. Don't forget that when you run your pay, wages and tax amounts are automatically debited from your account two business days before the direct credit date, so employees are paid on the direct credit date you selected.

Can I process my payroll via the employer app?

At this stage, direct debit processing is only available through the web application.

Will my employees still receive their payslips automatically on the direct credit date?

Unfortunately not, as we cannot identify when the money has been successfully received into the employee’s accounts, only when it was processed out of our account. You'll need to log in to Smartly and send payslips to your employees on the payment date, or if your employees’ are set up to use the Smartly app, they can view their payslips there.