Paying employees by piece rates

A piece rate is a commission where the employee is paid for the number of pieces they worked on, for example, being paid for the number of fruit bins picked.

Employees who are paid per piece must still receive the relevant minimum hourly rate. To check this, divide their total pay in the pay period by the number of hours they worked in that pay period.

A case study from Business New Zealand:

Glenn is the new manager of an orchard in Hastings. As he recruits pickers at a "bin rate" of $35 for each bin of apples, he tells them the average is three bins a day.

As Ollie, the owner, prepares to approve pay after the first week of harvest, he notices some pickers aren’t earning the daily minimum wage. They all work eight hours a day, but those picking three bins are only earning $105 a day instead of the $185.20 they’d earn if paid the hourly minimum wage.

In the above scenario, Ollie would need to top up his workers to ensure he is paying them the minimum wage.

The record of hours and number of days worked will also help determine the leave rate for when they go on leave.

Setting up an employee on piece rate

1. Click People, Add employee and enter all the employee details as normal.

2. Set the employee as a waged employee.

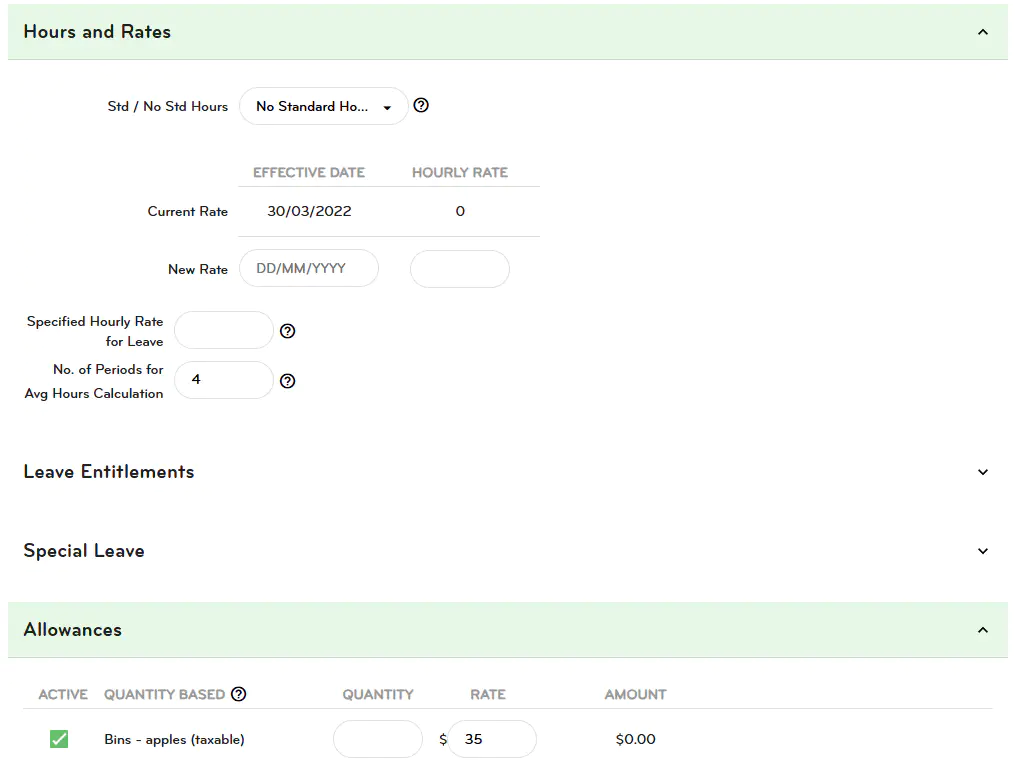

3. Set the employee to No Standard Hours.

4. Enter the pay rate as $0 per hour.

5. Tick on the relevant allowances for the employee. The rate for the allowance should be set.

6. Click Save.

Paying employees by piece rates under Run a Pay

When entering a piece rate staff member's wages there are three things you need to enter:

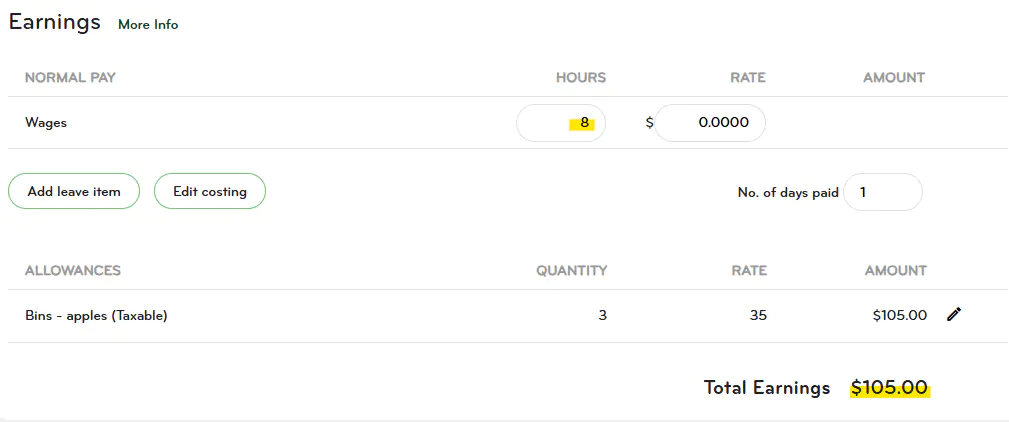

1. The hours worked.

2. The number of days paid.

3. The quantity for the allowance.

Note: Employees paid per piece must still receive at least the relevant minimum wage for each hour worked.

The reason why it is important to add the hours:

- Ensures the employee meets minimum wage.

- It is used to calculate the employee's average hours and leave rate.

In the above scenario, the employer needs to top their employee up as

$105 divided by 8 hours = $13.125 per hour.

The minimum wage for adults in 2024 is $23.15, so the employer needs to top up $80.20. He or she can do this by having another allowance line named 'Top up'.