Payroll cheat sheet

Learn about the basics of New Zealand payroll. Tax rates, KiwiSaver, leave and more.

Please note the information outlined in this article is for the tax year: 1 April 2024 - 31 March 2025.

Minimum wage

As of 1 April 2024, the minimum wage in New Zealand is $23.15 per hour and the minimum rate for training and starting out is $18.52. Ensure all employees aged 16 years or over are paid at least this.

For more information, you can visit the Employment New Zealand website here.

Final Pay

An employee’s final pay must include:

- payment for all hours worked since their last pay until they end.

- payment for annual leave and public holidays owing.

- any additional lump sums or other payments.

Inland Revenue

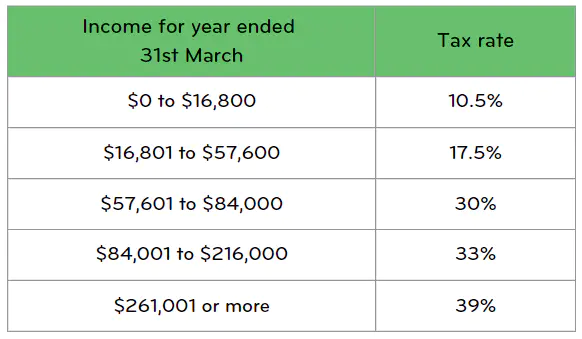

Personal income tax

Personal income tax has one threhold from 1 April 2024 - 30 July 2024. From 31 July 2024, there is a new threshold:

KiwiSaver

The rate you deduct employee contributions from their gross pay is the following:

- 3%, 4%, 6%, 8% or 10%

Your employee tells you which rate to use on their KiwiSaver deduction form – KS2 (available on the IRD website).

If an employee is using KiwiSaver and does not choose a contribution rate, use the default rate of 3%.

Employers must contribute a minimum of 3% of their employee’s gross salary or wages to their KiwiSaver. Employers must make these payments every payday. This is in addition to the employee’s gross salary or wages.

Employer superannuation contribution tax (ESCT)

A tax on any cash contribution an employer makes to a superannuation fund for the benefit of an employee. For example, employer contributions to an employee's KiwiSaver.

The employee ESCT rates are:

There are 2 ways to deduct ESCT, you can either:

- deduct ESCT from each employer contribution

- include your employer contribution in your employees' gross salary or wage. Tax is deducted under the PAYE rules.

Smartly automatically deducts this along with PAYE.

Payday filing

Payroll information is filed directly to IRD via payroll software (like Smartly) or online. Employee’s earnings information is sent to IRD to make sure that tax is calculated correctly and shows correctly in the myIR portal.

You need to do this every payday. Make sure new employees are set up using the IR330 (tax code) and KS2 (KiwiSaver form). Electronic filing needs to be completed within 2 working days of each pay.

PAYE and payments to IRD

PAYE payments are due to the IRD by the 20th of each following month. If you’re a large employer it’s by the 20th of the same month and by the 5th of the following month.

A large employer is a business with PAYE and ESCT more than $500,000 per year.

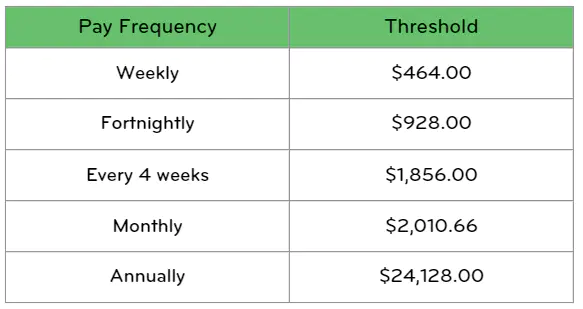

Student loan

Student loan repayments need to be deducted for employees with a tax code ending in SL. Repayments are deducted at 12 cents in the dollar for every dollar the employee earns over the threshold for tax codes M SL and ME SL (see table below).

For other tax codes ending in SL, deductions are made for every dollar the employee earns.

Child support

If child support payments need to be made, make sure they are deducted correctly. IRD will let you know when and how much to deduct.

Leave

Annual leave

Everyone is entitled to 4 weeks of annual leave per year. Currently, this becomes available after 12 months of continuous employment, but an employer can make this available in advance.

Leave balance should be held in weeks, rather than hours.

A maximum of one week (out of the employee’s 4-weeks minimum entitlement) can be cashed out for each entitlement year.

Sick leave

- Minimum sick leave entitlements are 10 days per year for employees who have had six months of continuous employment or have worked for the employer for six months for:

- an average of 10 hours per week, and

- at least one hour every week or 40 hours every month.

- This becomes available to employees after 6 months of employment.

- The maximum amount of sick leave that an employee can accumulate is 20 days, unless otherwise stated in an employment contract.

- Sick leave is not paid out to employees upon termination of employment.

Parental leave

A parent is entitled to 26 weeks of paid leave and a further 26 weeks of unpaid leave subject to relevant eligibility criteria. For further information, please check out the IRD website.

The amount an employee is paid during parental leave is equal to their ordinary weekly pay or average weekly income up to $754.87 a week before tax for the 1 July 2024 to 30 June 2025 period. IRD makes this payment directly.

Employees continue to accrue annual leave while on parental leave.

About Smartly

Not a Smartly customer? Sign up or switch today.

Payroll legislation, the Holidays Act, leave entitlements and more, it’s a lot to get your head around. Our automated and simple to use payroll software can sort this all for you. Learn about Smartly and sign up today.

Please note the information outlined in this article is for the tax year. 1 April 2024 -31 March 2025.