Pre-Tax Deductions

If your employee has a deduction that needs to be taken before tax, such as a Workride payment, follow the steps below to set it up as a pre-tax deduction in Smartly.

What is a pre-tax deduction

A pre-tax deduction is an amount taken from an employee’s gross pay before tax is calculated.

This reduces their taxable income and is commonly used for repayments such as:

- Workride

- Company car payments

- Childcare costs

Setting up a pre-tax deduction

1. Go to Settings > Payroll settings

2. Now, click on Pay components

3. Select the Deductions tab

3. Click Add to create a new deduction

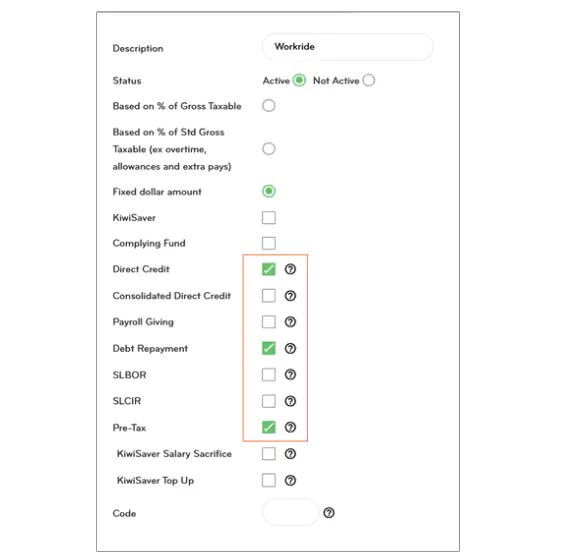

4. Enter a name in the Description field (e.g., Workride)

5. Under the Deduction settings, tick the boxes that apply:

- Pre-Tax – required

- Debt Repayment – optional; tick if you want the deduction to automatically stop once the total debt is paid

- Direct Credit – optional; tick if the Deduction payments are to taken from the employee's pay and transferred to a specific bank account. Note: This will be automatically selected if you tick Debt Repayment, but you can deselect it if needed

6. Set the deduction calculation method:

- Fixed dollar amount – most common; allows you to set an agreed repayment amount later on (e.g., $100 per pay period).

- Based on % of Gross Taxable

- Based on % of Std Gross Taxable

7. Click Save when you’ve entered your settings

Applying the pre-tax deduction to employees

After creating the pre-tax deduction, you will need to apply it first to the appropriate contract group(s), and then to individual employees as needed.

1. Apply to the contract group level

1. Go to Settings > Payroll settings

2. Click the Contract groups tab

3. Select the relevant group under Description (e.g., Waged Employees or Salaried Employees etc.)

4. Scroll down to the Deductions dropdown and tick the box for the deduction you created (e.g., Workride)

5. Enter the Direct Credit info if you previously selected this option on

6. Click Save once done

.png/_jcr_content/renditions/optimized.webp)

2. Apply to an individual employee

1. Go to People and select the employee you want to add the pre-tax deduction to

2. Click the Payments tab

3. Scroll down to the Deductions dropdown and tick the box for the deduction you created (e.g., Workride)

4. Fill out the relevant fields:

- Quantity

- Rate (amount deducted each pay period, e.g., $100)

- Total Debt Owing (if Debt Repayment was ticked)

- Direct Credit details (if applicable)

5. Click Save once done

.png/_jcr_content/renditions/optimized.webp)

Review in pay summary

Once set up, a new pre-tax deduction section will appear in the employee’s pay summary, showing:

- The deduction amount

- The impact on gross pay before tax

Pre-tax deductions are taken before calculating PAYE, which reduces taxable income and may lower overall tax liability.