Removing the old workaround

Previously, Smartly did not support KiwiSaver salary sacrifice directly. Businesses often manually adjusted employee pay rates to work around this. With Smartly's new pre-tax deduction functionality, these manual adjustments are no longer needed.

You can calculate an employee’s original wage or salary using their current pay and the existing KiwiSaver employer contribution rate (Benefit rate).

To calculate the original rate from an adjusted rate, use this formula:

Example 1: Employee's adjusted hourly rate is $24.27 (2dp) and the KiwiSaver employer contribution is 3%

Original rate = $24.27 × 1.03 = $25

Example 2: Employee's adjusted salary is $58,252.43 (2dp) and the KiwiSaver employer contribution is 3%

Original rate = $58,252.43 × 1.03 = $60,000

Now, you can restore employees’ original pay rates and automatically apply KiwiSaver salary sacrifice deductions by following the steps below.

Restoring an employee’s pay rate

1. In Smartly, go to People

2. Find the employee and click the chevron (˃) at the end of their line

.png/_jcr_content/renditions/optimized.webp)

3. Select the Payments tab

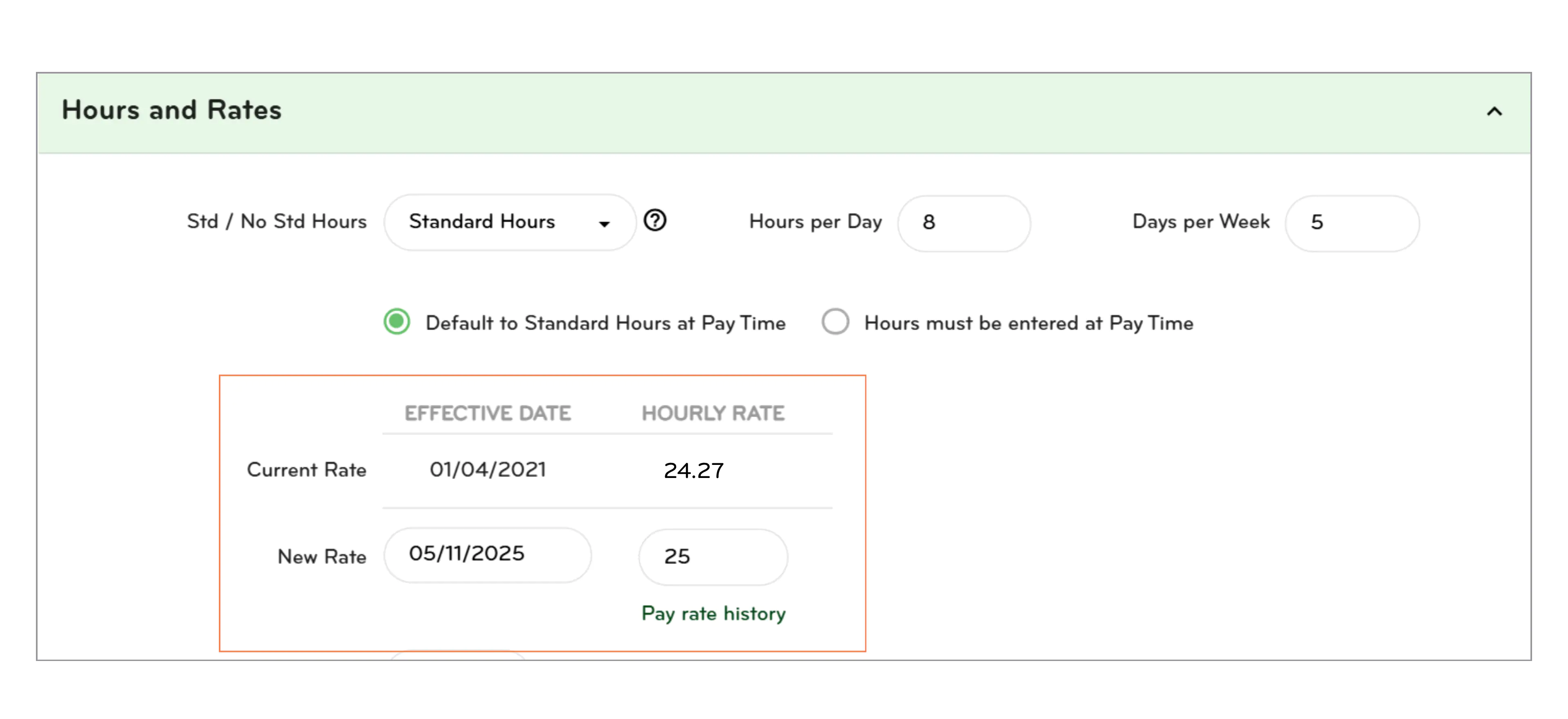

4. Find the New Rate field

5. Under Rate Start Date, enter the start date of the next pay period

6. In the New Rate field, enter the employee’s pre-sacrificed rate (the rate before any manual adjustment)

7. Click Save once done

Creating and adding the new KiwiSaver salary sacrifice deduction

Once you’ve removed the old workaround, you can now set up the new KiwiSaver Salary Sacrifice in Smartly. This updated setup makes it simple to manage employee contributions directly through the system.

For step-by-step instructions on how to create and apply the new deduction, please refer to our KiwiSaver Salary Sacrifice article.