Christmas payroll guide

Smartly is all about making it easier for you to sort your payroll! This guide walks you through all the common payroll queries and answers all your FAQs this holiday season.

This guide covers:

- Adding a bonus

- How to pay annual leave and statutory days in one pay period

- How to pay multiple future pay periods

- Working on a public holiday

- Company closedowns

- Terminations over the Christmas period

For a PDF version, please see here.

Adding a bonus

It’s important to note that regular bonuses are paid as taxable allowances, while one-off or irregular bonuses are paid (or entered) as one-off payments. The information below explains how to pay a bonus using either gross or net amounts as a one-off payment.

Adding a bonus in bulk for multiple employees

If your employees are submitting leave requests or timesheets via the Smartly mobile app or web browser, please ensure all leave hours and working hours have been approved before the one-off payments in bulk are loaded.

This applies when paying one-off payments in bulk with a normal pay.

If changes are made to an employee’s leave and/or working hours after a bulk one-off payment has been actioned, clear the employee’s pay, reload the correct leave and/or working hours, and manually add the one-off payment.

1. Go to Pay > Run a pay.

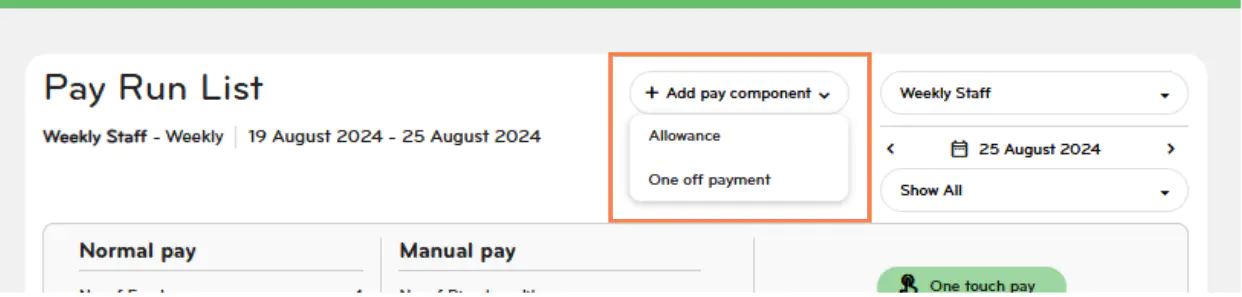

2. Click on the Add pay component dropdown and select One off payment.

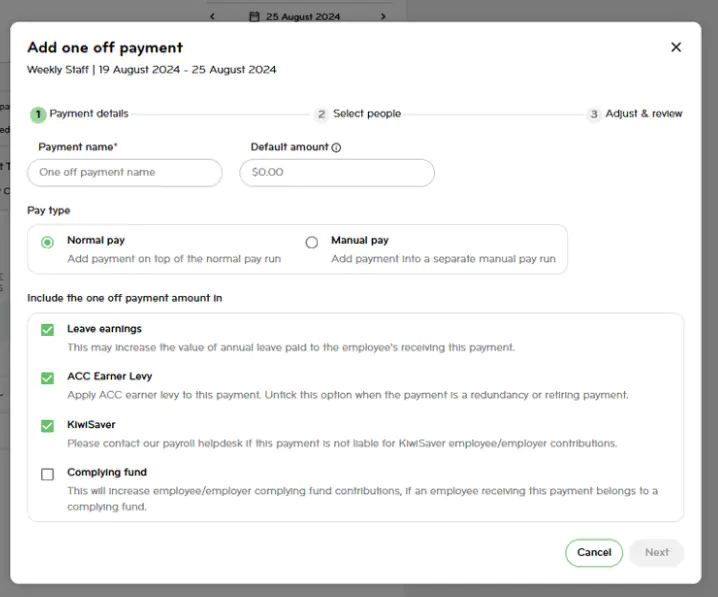

3. Enter the payment name.

4. If you want all the employees receiving a one off payment to receive the same amount, add the amount into the Default amount section.

5. Select Normal pay or Manual pay then click Next. The employer needs to determine on their end if the payment should be included in leave earnings or not.

6. Select the employees you want to receive the one off payment. Check the tick box at the top to select all of them or check them off individually.

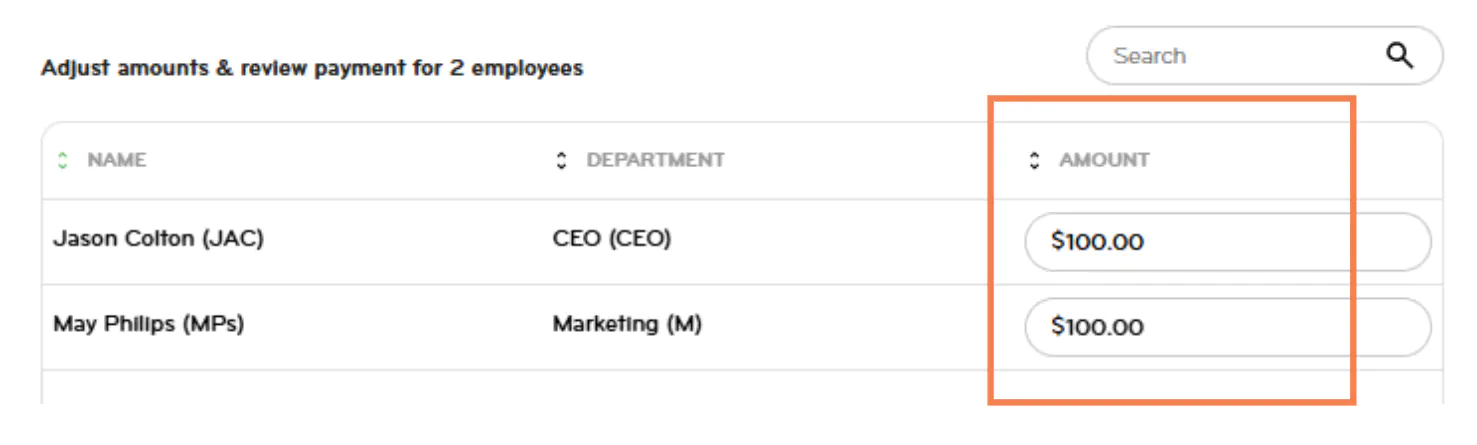

7. If you added in a default amount, you’ll see that amount next to each of the employees. You can edit this if needed. If you left the default amount blank, add in the appropriate amount next to each employee receiving a one off payment.

8. Once you’ve added in all your one off payments, click Done and then Add.

Adding a bonus for a gross amount for an individual employee

The best way to enter a bonus for a gross amount for an individual employee is to add it as a one-off payment in the employee’s pay, either as a normal pay or a manual pay.

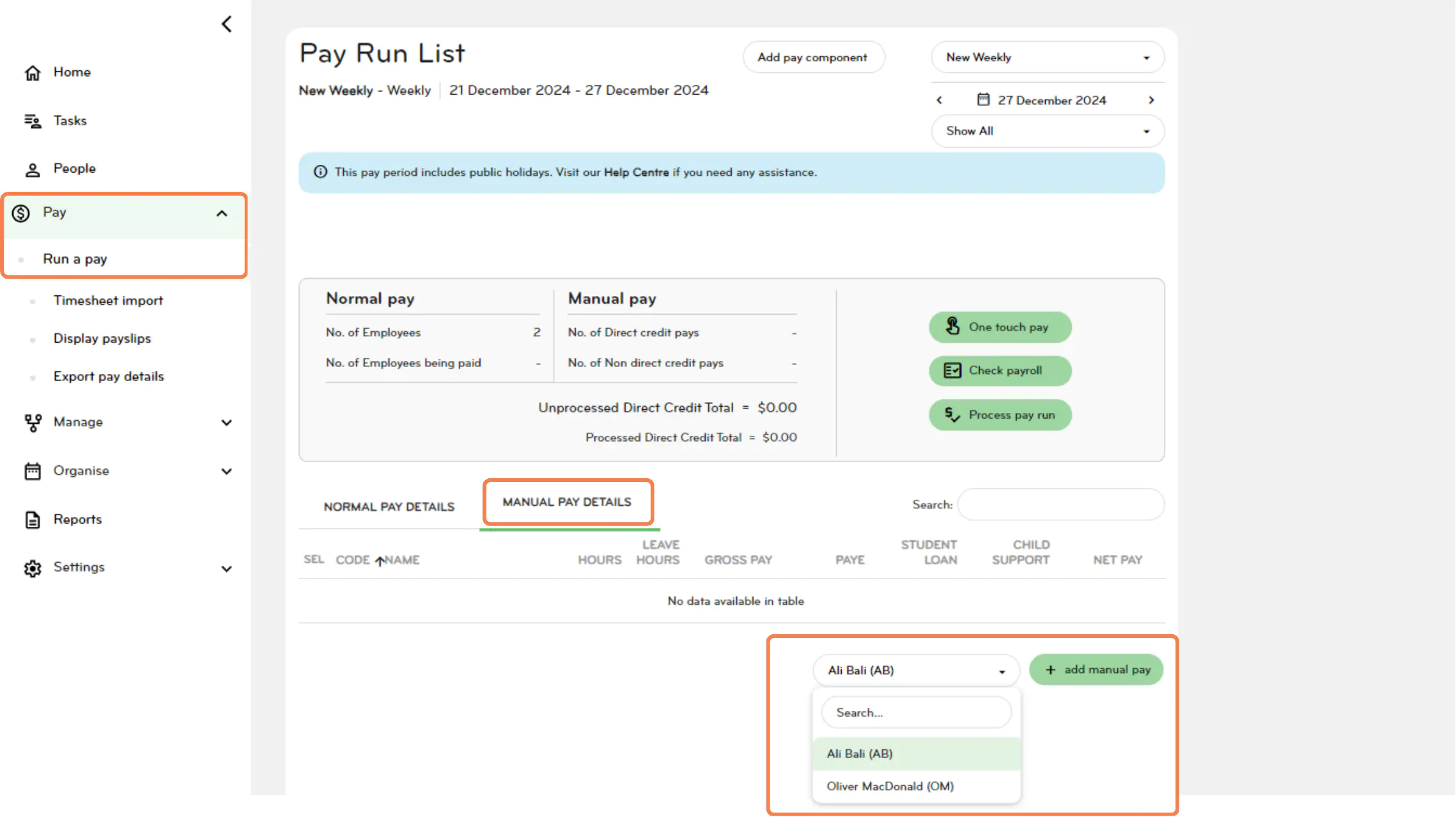

1. To pay a bonus, go to ‘Pay’, then ‘Run a pay’ and double-click the employee to process it as a normal pay, or go to ‘Manual pay details’ and select the employee to process it as a manual pay.

2. Then select Add one off payment.

.png/_jcr_content/renditions/optimized.webp)

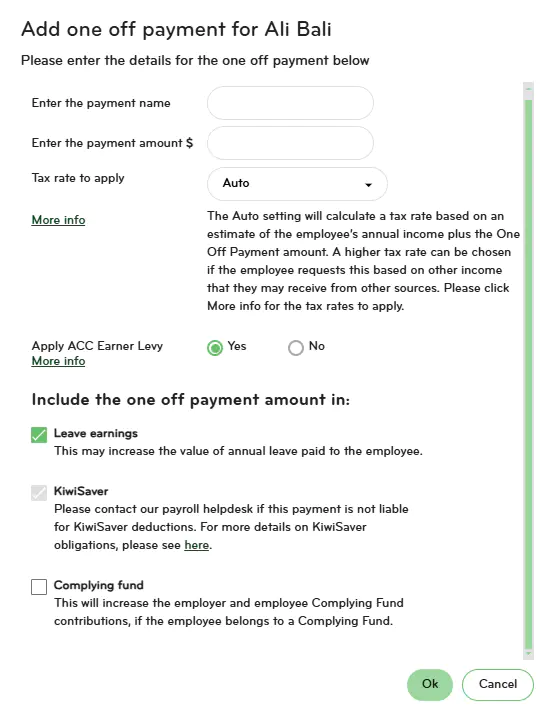

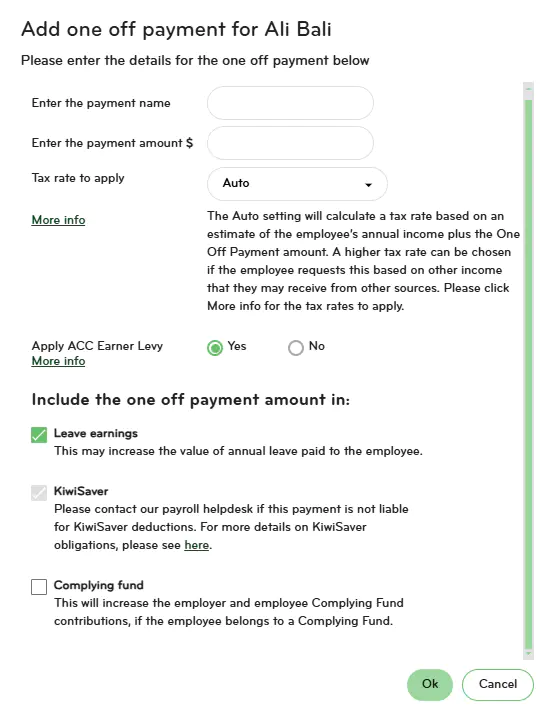

3. Enter the name for the payment.

4. Enter the gross amount for the payment.

5. The tax rate should show as Auto and ACC earner levy should be ticked on as Yes.

6. If the bonus is not a discretionary payment, then the Leave Earnings option will need to be left on. If the bonus is a one-off discretionary payment, then Leave Earnings can be unticked.

7. KiwiSaver should be ticked if the employee is contributing.

8. When you click Save, you'll be asked for the DC date. This is needed to ensure PAYE is calculated correctly.

Important: Refer to the Employment New Zealand website for more information about gross earnings and discretionary payments.

Adding a bonus for a net amount for an individual employee

Some employers prefer to pay a bonus as a net amount. You can do this by running either a normal pay or a manual pay for the employee. In this case, you’ll need to determine the gross amount that results in the desired net payment.

1. Head to Pay, Run a pay.

2. Check you're in the correct pay period in the top right of the screen.

.png/_jcr_content/renditions/optimized.webp)

3. Click on Normal pay details or Manual pay details depending on how you want to process the pay.

4. Select the employee you are paying the bonus to.

5. If you’re running the pay as a manual pay, click + Add manual pay as shown below.

6. Once you're in the pay details screen, select Add one-off payment.

7. Enter the name for the payment.

8. Enter the gross amount for the payment.

8. The tax rate should show as Auto and the ACC earner levy should be ticked on as Yes.

9. If the bonus is not a discretionary payment, then the Leave Earnings option will need to be left on. If the bonus is a one-off discretionary payment, then Leave Earnings can be unticked.

10. KiwiSaver should be ticked if the employee is contributing. When you click Save, you'll be asked for the DC date.

11. This is needed to ensure PAYE is calculated correctly.

Important: For more information about what a discretionary payment is, we recommend referring to this Employment New Zealand article.

Check the net amount is correct

Once you've saved the pay, the system will calculate the PAYE deduction and display the net amount at the bottom of the employee’s pay summary on the right-hand side that shows the gross pay.

You can check here that the net amount is correct.

1. If the net amount needs to be changed, click on the pencil icon and change the gross figure until your desired net amount is reached.

.png/_jcr_content/renditions/optimized.webp)

2. Click Ok and then re-save the pay. You can amend the amount until it's correct.

3. To set up another bonus for another employee, click Back to Pay Run.

Recording leave that spans more than one pay period

When recording Annual Leave that spans across more than one pay period, ensure the Annual Leave entry is recorded as one continuous block of leave.

This also applies when any DBAPS ( Domestic Violence, Bereavement, Alternative, Public holidays, and Sick) leave is taken during a period of Annual Leave.

The Annual Leave rate must be calculated at the start of the Annual Leave period and this rate must be applied for the whole period of Annual Leave. This ensures compliance with the Holidays Act 2003. Only a return to work requires the Annual Leave entry to be split.

This applies to employees on Standard Hours. For employees on No Standard Hours, always check the Leave Hours are correct and make an adjustment if required.

Example

What to do

If an employee takes Annual Leave from 22nd December to 4th January, and the Christmas and New Year public holidays fall within that period:

Enter one Annual Leave request from 22nd December to 4th January.

- The system will automatically exclude the public holidays, so only the working days are deducted as Annual Leave.

- The Annual Leave rate will be calculated once, based on the rate when the leave began.

- The public holidays will automatically be applied in the correct pay period.

What not to do

Do not split it into separate entries such as "23 to 24 December Annual Leave", "25 and 26 December Public Holidays", and "27 December to 3 January Annual Leave". Splitting the leave causes the system to recalculate the rate for each period.

Recording leave

When an employee takes leave, always record the leave entry in the same pay period as when the leave was taken. This applies to all types of leave, statutory holidays and regional anniversaries.

If employees submit leave requests via the Smartly mobile app or web browser, once approved, the leave entries will automatically populate into the correct pay period, based on the dates of the leave request.

Auto-adjust pay packets for public holidays

To ensure all New Zealand public holidays automatically populate into the pay run for your employees, follow these steps:

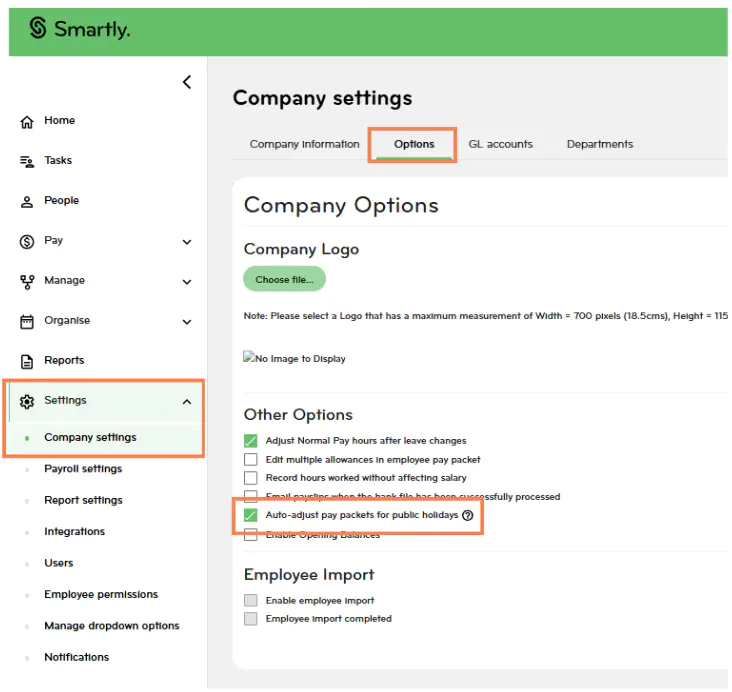

1. Head to Settings, then Company settings

2. Select Options, then tick the Auto-adjust pay packets for public holidays box

Note: employees with a work pattern must have this work pattern recorded accurately in their employee profile.

This will ensure Smartly can determine whether a public holiday is a normal working day for your employees.

How to process multiple future pay periods

In Smartly you can set up pays with Direct Credit dates (DC dates) up to 30 days into the future.

This gives you the ability to enter pays before you go on holiday, so you don't have to worry while you're enjoying your break.

Important: It's important you enter pays in date order i.e. you can't skip a pay period and enter pays for another week, then go back to the period you skipped.

To enter pays in advance, follow the steps below:

1. Head to Pay, Run a Pay and enter the pays for the first pay period as normal. Click Process pay run, enter the Direct Credit date and submit.

2. Now go to the next pay period date by using the arrow on the top right-hand side. Enter the pays and process for the next Direct Credit date.

.png/_jcr_content/renditions/optimized.webp)

Working on a public holiday

To determine how your employee should be paid when they work on a public holiday, you need to check if they usually work on this particular day.

1. If the Public Holiday is their normal work day, the employee should be paid time and a half for the hours worked plus they are also entitled to earn an Alt. Public Holiday.

2. If it is not their normal work day, the employee is only entitled to be paid time and a half for the hours worked.

Refer to the Employment NZ website for more public holiday scenarios.

Company closedowns

If your business has an annual close down period requiring your employees to take their Annual Leave or have unpaid time off, it's important that you give them at least 14 days notice.

For employees who have not yet reached their first Annual Leave anniversary, you may be required to pay them 8% of their total gross earnings

Please contact our Customer Support team on 0800 10 10 38 for assistance with processing closedown payments for affected employees.

Refer to Employment NZ’s flowchart to determine whether the closedown provisions apply. For more information about annual closedowns, we recommend visiting Employment NZ.

Lump sum payments

If you're making a lump sum payment to an employee, such as a bonus or a closedown payment, the tax can be higher than usual. It can also affect any ACC, KiwiSaver and Student Loan repayments.

Important: Smartly cannot alter tax amounts and we recommend getting in touch with IRD if you need more information.

Public holidays while on annual leave or leave without pay

Annual

- If an employee is being paid annual leave when there is a public holiday, they're entitled to be paid for the public holiday instead of using their annual leave. This applies when the public holiday is a normal working day for the employee.

Leave without pay

- If an employee is on leave without pay when there is a public holiday, they are not entitled to be paid for the public holiday. This is because the employee had no intention of working on that day.

- However, if the employee is on leave without pay because they have no sick leave available, then they would be entitled to the public holiday.

Important: These situations aren't always straightforward, so if you're unsure, we suggest contacting MBIE on 0800 20 90 20.

Terminations over the Christmas period

If an employee is finishing work near or during the Christmas period, it’s important to check if they have any earned leave. If an employee has earned leave that stretches across any public holidays, they are entitled to be paid for the public holidays in addition to any holiday pay that is owed.

Scenario 1

An employee works Monday to Friday, 8 hours per day.

The employee finishes work on Friday 19th December 2025 and at this time, they have 32 hours of earned annual leave available.

Because their Earned Leave stretches past Christmas Day and Boxing Day, the employee is entitled to be paid for both of these public holidays, in addition to any holiday pay owed:

Here's how you can easily check if an employee has earned leave available:

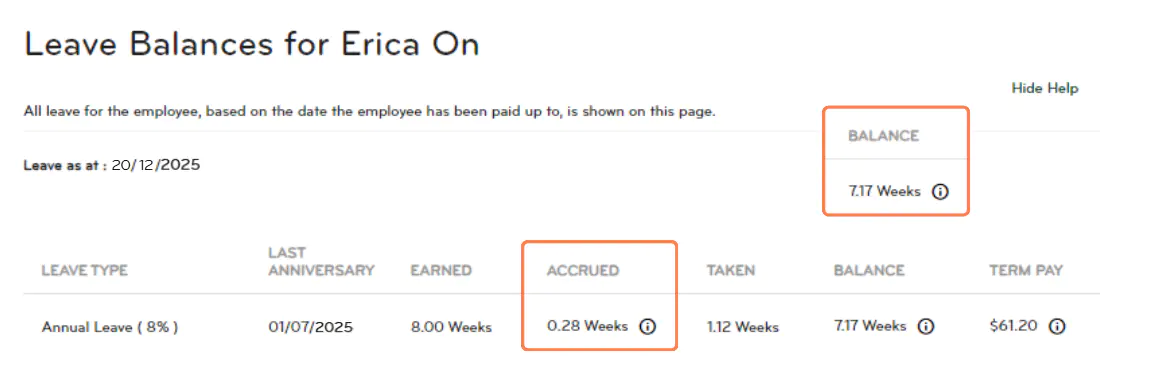

1. Click on People in the left-hand menu. Select the correct employee, and then click on Leave.

2. The employee's leave balances will be displayed. You can subtract the accrued leave from the balance and this will give you the earned balance.

Scenario 2

In this example, subtract the accrued leave 0.28 weeks, from the balance of 7.17 weeks.

7.17 – 0.28 = 6.89 weeks

This employee is entitled to be paid for any public holidays in the upcoming 6.89 weeks.

In this example, the employee also qualifies for Waitangi Day (+ Wgtn, Akld or Nelson Anniversary if that applies).

Work patterns

To ensure Smartly correctly determines payments for leave and public holidays, enter a work pattern for employees who work consistent hours and/or days in a repeatable cycle.

For more information https://smartly.co.nz/support/help-centre/employer/employee-changes/work-pattern