Contractors (For kōhanga sites)

Before setting up your contractors in Smartly, please obtain the following information from them:

- Name (can be individual name or company name).

- IRD number (A personal IRD number must be used unless the contractor meets the following IRD criteria - “operating in the agricultural, horticultural or viticulture industries or they are operating under a labour hire arrangement, or they are a non-resident contractor.” If you are unsure whether they meet this criteria please check with IRD).

- Withholding tax rate (They need to give you a completed Tax rate notification for contractors - IR330C).

- Whether they are GST registered or not.

- Address

- Bank account number

Contractor's allowance

A contractor is often paid by their billed amount rather than an hourly rate. To pay them by their billed amount, the allowances section would need to be set up. If you do not yet have three contractors' allowances set up under your Company details > Pay components > allowances section, please call us on 0800 10 10 38 to set those up for you. Also let us know if you would like us to set up a separate Contractors contract group for you.

If the contractor was GST registered, they would have two allowances set up:

- Contractors Invoice - GST (Taxable).

- GST (Non Taxable).

If the contractor was not GST registered, they would only need one allowance to be set up:

- Contractors Invoice - No GST (Taxable).

Contractor's contract group

There are two default contract groups in your Smartly site: Salaried employees and Waged employees. While it is not mandatory to have a separate contract group named Contractors, having a separate group would ensure all your contractors' settings are correct. These settings include:

- Not being eligible for KiwiSaver.

- Not being eligible for leave entitlements.

- The three contractor allowances are available to use.

You can check your contract groups by going to Company details > Contract groups. If you would like us to set up a Contractor contract group, please call us on 0800 10 10 38.

Adding a contractor to your Employee list

1. Log into your site and go to Employee details.

2. Select Employee list.

3. Click on Add Employee.

4. Follow the Employee Wizard, filling in all the information.

Note: Anything with * is a mandatory field, and the page will not save if it is left blank.

5. Select the Exempt option for KiwiSaver as Contractors are exempt from KiwiSaver contributions. Leave the reason blank as there is no Contractor option to choose.

6. Select WT for their Tax Code and enter the Withholding Tax rate the contractor has provided.

7. Select their Tenure as Casual and choose the Contractors Employment Contract Group that you set up.

8. Click Save and go to next step.

9. You will now be on Step 2 of 2.

10. The Standard Hours should have automatically populated as No Standard Hours as you selected Casual as the Tenure.

11. Enter 0 as the Hourly Rate.

12. Open up the Allowances section and tick the allowances you require for this Contractor and enter the Rate if they have one.

Note: If they are GST registered, select the Contractors Invoice - GST (Taxable) allowance and the GST (Non Taxable) allowance. If they are not GST registered, select the Contractors Invoice - No GST allowance only.

13. Click Save.

Paying a contractor

Non-GST registered contractor

- Run a pay.

- Double click on the contractor.

- Click on the edit pencil next to Contractors Invoice-No GST.

- Enter Quantity: 1.

- Enter Rate: the billed amount.

- Click Ok and Save.

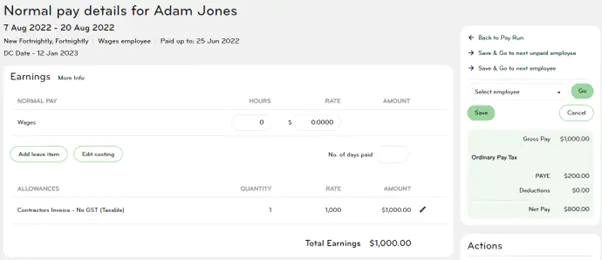

In the example below, the contractor Adam Jones is billing for $1,000. He is on a withholding tax rate of 20%.

GST registered contractor

To pay a GST registered contractor, please go to:

- Run a pay.

- Double click on the contractor.

- Click on the edit pencil next to Contractors Invoice- GST.

- Enter Quantity: 1.

- Enter Rate: the billed amount exclusive of GST.

- Click Ok.

- Click on the edit pencil next to GST.

- Enter Quantity: the same as the billed amount exclusive of GST.

- Enter Rate: 0.15 (as GST is 15%)

- Click Ok and Save.

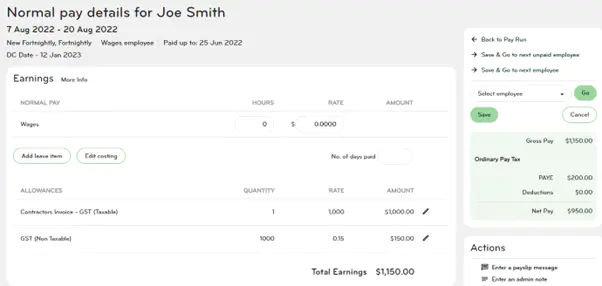

Example: Joe Smith is billing for $1,000 plus GST.

Contractor's Invoice - GST: Quantity: 1. Rate: $1,000

GST: Quantity: $1,000. Rate: 0.15

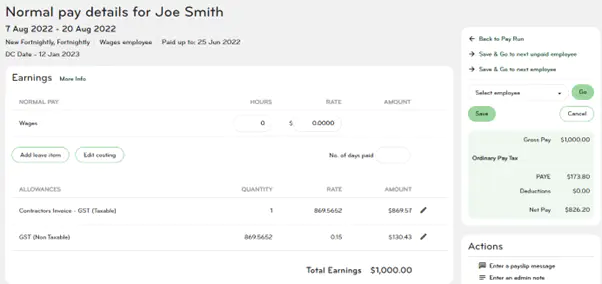

Example: Joe Smith is billing for $1,000 inclusive of GST.

Contractor's Invoice - GST: Quantity:1. Rate: $869.5652 (calculated by $1000 divided by 1.15).

GST: Quantity: $869.5652. Rate: 0.15