Deductions

Setting up a deduction

1. Click on Company details.

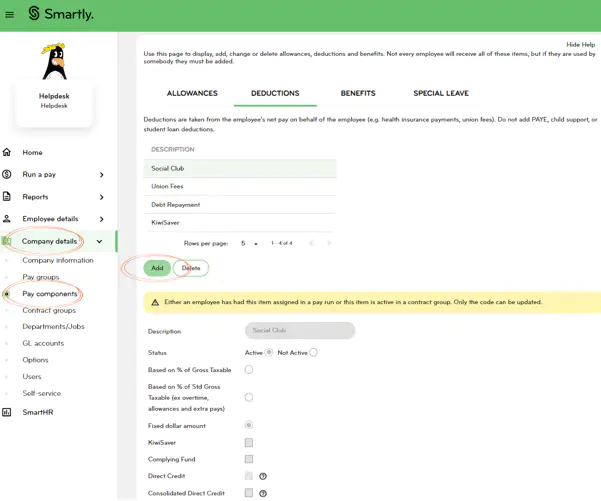

2. Now, click on Pay components.

3. To set up a deduction, go to the Deductions tab and click on Add.

4. Enter the name of the new deduction.

5. Select the type of deduction you want, e.g. fixed dollar amount, based on percentage.

6. Select the options that apply. Click on the ? for information about the options.

7. Click Save.

8. Click on Contract groups.

9. Now select the Contract group you would like the deduction applied to, e.g. salaried employees, waged employees..

10. Scroll down the page to Deductions and tick the box next to the new deduction to apply it to this contract group.

11. Click Save. Repeat for any other contract group that the deduction will apply to.

12. Now go to the Employee Details screen.

13. Select Employee list.

14. Select the employee, then go to Employee payments.

15. Scroll down to Deductions and tick on the new deduction you have set up.

16. The deduction will automatically be available in the Run a pay area. If you've already entered hours for the employee, you should clear the pay and enter the hours again.

Deductions report

This report shows which deductions have been drawn from employee pays over one or more pay periods.

1. Go to Reports.

2. Click on Report generator.

3. Select Payroll as the report category.

4. Select the Deductions report.

5. Choose which deduction, pay group, department and employee/employees you would like to include. You can choose more than one if applicable.

6. Choose the date range or the period end date you want to run the report for.

7. Select Display.