Employee pay rates (For kōhanga sites)

How to change an employees pay rate or salary

1. Go to Employee details.

2. Select Employee list.

3. Highlight the employee you want to update the pay rate for.

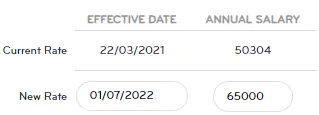

4. Now click on Employee payments.

5. In the New Rate section, enter the date the new pay rate will be effective from and then enter the new salary or hourly rate.

6. Click Save.

Note: If the effective date is part way through a pay period, the system will have the two rates available in the pay details screen so you can allocate the correct rate for the correct days.

How to pro-rata a salary when changing the hours for a salaried employee

If an employee is changing their hours, but their salary is staying the same, you'll need to pro-rata their salary as Smartly does not do this automatically.

There are different methods of calculating the employee's pro-rata salary.

Example: Mary was on $60,000 for working 40 hours per week. She is now dropping her hours down to 32 hours per week

Method 1: Use the employee's new FTE (full time equivalent) multiplied by the full salary.

1. Establish the new FTE by dividing the new hours over the full time hours.

32 hours/40 hours = 0.8FTE

2. Multiply the new FTE by the full salary.

$60,000 X 0.8 = $48,000.

Mary's pro-rata salary is $48,000.

Method 2: Multiply the annual salary hours equivalent by the new hours the employee will be working.

1. Divide the annual salary by the hours it is equivalent to.

$60,000/40 hours = 1,500

2. Multiply the above figure by the new hours the employee will be working.

1,500 X 32 hours = $48,000.

Mary's pro-rata salary is $48,000.

Method 3: Calculate the hourly rate the employee is on, and multiply the hourly rate by the new hours per week across the whole year.

1. Work out the hourly rate. Divide the salary by 52 weeks and the employee's original hours per week.

$60,000/52 weeks/40 hours = 28.8461538462

2. Multiply the hourly rate by the new hours per week across the year.

$28.8461538462 X 32 hours X 52 weeks = 48,000.00

Mary's pro-rata salary is $48,000.

If you'd like some help with this, call us on 0800 10 10 38 or email helpdesk@smartly.co.nz

How to add an additional pay rate

To add an additional rate for an employee in Smartly, follow the steps below:

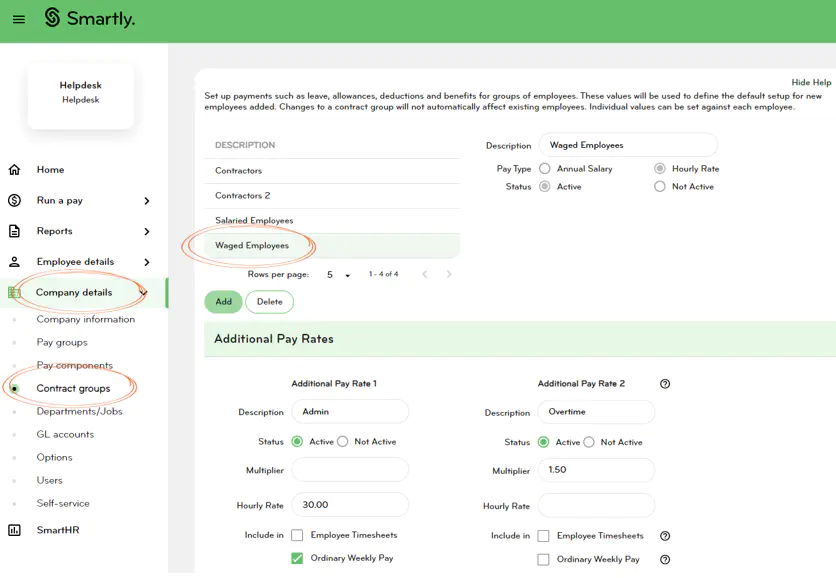

1. Go to Company details.

2. Click on Contract groups.

3. Select the right pay group e.g. Waged employees

4. Under Additional Pay Rates change the status to Active and add the additional rate. You can either enter an hourly rate or use a multiplier. Eg, Overtime paid at time and a half will have a multiplier of 1.5.

If the additional pay rate is to be used for multiple employees but paid at different rates, enter the multiplier as 1 and then override the rate on the Employee payments screen in Step 6.

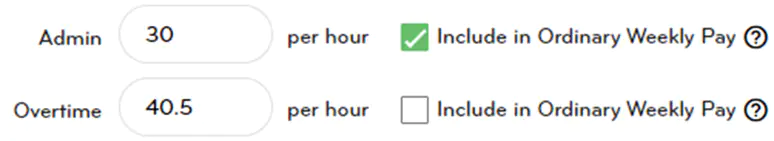

Note: If you select the additional pay rate to be included in Ordinary Weekly Pay, it will include payments made at this rate in the employees Average Weekly Earnings, as well as in their Ordinary Weekly Pay if a work pattern exists for this pay rate. Select this option only where payments at this rate are a part of employees standard pay each pay period.

5. Press Save.

6. Go to Employee details.

7. Select Employee list.

8. Highlight any employee from the Contract group you just set up the additional rate for.

9. Now click on Employee payments and you should see the additional rate.