Historic leave earnings

Historic leave earnings are used to accurately calculate your employees' leave rate when they are transferred across to Smartly. We will need to make sure we capture this information so the leave rates for all employees that accrue annual leave will be accurate. If we do not receive this data, your employees could have incorrect leave balances and you may not be compliant with the Holidays Act 2003.

To ensure Smartly has what it needs to calculate the leave rates, we will require historic pay information for up to 53 weeks and leave balances owing for each employee. We will need this information for all employees who have leave balances.

Historic earnings template

Up to 53 weeks of historic earnings can be entered for each employee. This information will be used to accurately calculate leave rates when coming from another payroll system.

There should be a separate tab for employees that are paid on a different frequency (weekly, fortnightly, monthly)

Please make sure the most recent pay date is at the top and the oldest at the bottom.

The date should be written in the following format: DD/MM/YYYY (e.g., 31/07/2022).

All cells should be completed. Where there is no amount to enter, please load as 0.00

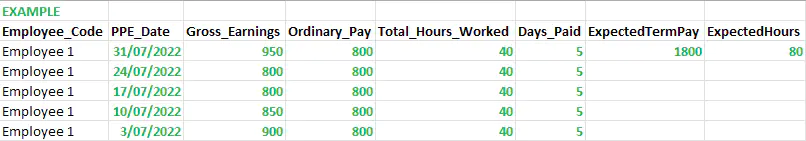

Now let’s look at an example of how to fill out the template.

PPE Date (Pay Period End Date) | This is the pay period in which you pay your staff – weekly, fortnightly, or monthly pay periods. The date at the top should be the last pay you ran before starting with Smartly. |

Gross Earnings | This includes the below list of payments: Salary and wages. All taxable allowances (not reimbursing allowances). All overtime paid. Most commissions, bonuses and incentives, payments for annual holidays and public holidays. Payment for sick and bereavement leave. |

Ordinary Pay | Includes everything an employee is normally paid weekly before tax. Does not include any payments that are irregular (e.g., irregular overtime). Cash value of board and lodgings. Regular allowances e.g., shift allowances. General Rule: Include any payments made often to your employee. |

Total Hours Paid | Total of all hours worked in a pay period. This includes hours of leave taken. Should not be 0.00 if Gross Earnings have a value. |

Today Days Paid | Total of all days worked in the pay period. This includes days of leave taken. Should not be 0.00 if Gross Earnings have a value. |

| Expected Term Pay | The expected termination pay value for the employee. |

| Expected Hours | The expected annual leave balance (hours) for the employee. |

Historic earnings FAQs

What is the Historic Earnings Template used for?

Essentially the Historic Earnings is used by the Smartly site to calculate an accurate leave rate i.e., the monetary amount that the balance of leave is worth. Without this data, our system may not be able to calculate the compliant leave rate, which could potentially disadvantage the employer.

Where can I find this information in my current payroll system?

Most payroll software would track the weekly payments in a Pay History Report, or Earnings Report (sometimes called a Detailed Earnings Report or Gross Earnings Report).

What if I’m changing Pay Periods from Fortnightly to Weekly?

The Historic Earnings Template will need to be filled in as per the Pay Period selected on the Smartly site i.e. if you are starting on a weekly pay period with Smartly but your current data is fortnightly, this will need to be converted for the template.

What about Covid Subsidies, Parental Leave and ACC?

Covid subsidies should just be added to the Gross and Ordinary total in the Pay Period. The hours allocated for the subsidy should be the amount divided by the hourly rate.

Parental Leave need to be entered. You would record the rate as zero and the number of hours as the employee's normal number of hours (or their average weekly hours if they worked non-standard hours prior going on Parental Leave). You need to enter hours for every pay period that your employee is on Parental Leave.

ACC first week should be added at 80% of Ordinary Earnings and hours/days as they are. Any subsequent ACC leave should be recorded as zero earnings/hours/days if they weren’t paid through payroll. If they were paid by the employer, i.e., top-up, then record any earnings, hours, or days as they are.

What is a regular payment for Ordinary Weekly Pay? Click here for more information.

Gross earnings to calculate the payment for holidays and leave. Click here for more information.

Ordinary Weekly Pay vs Average Weekly Earnings (OWP vs AWE). Click here for more information.