Easter and ANZAC Day payroll

Easter payroll

Dates for Easter this year (2025) are:

- Good Friday - Friday 18 April.

- Easter Monday - Monday 21 April.

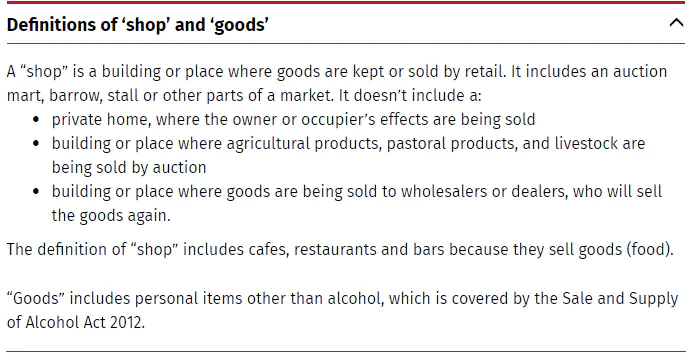

For your Easter payroll, see the flowchart below:

ANZAC Day payroll

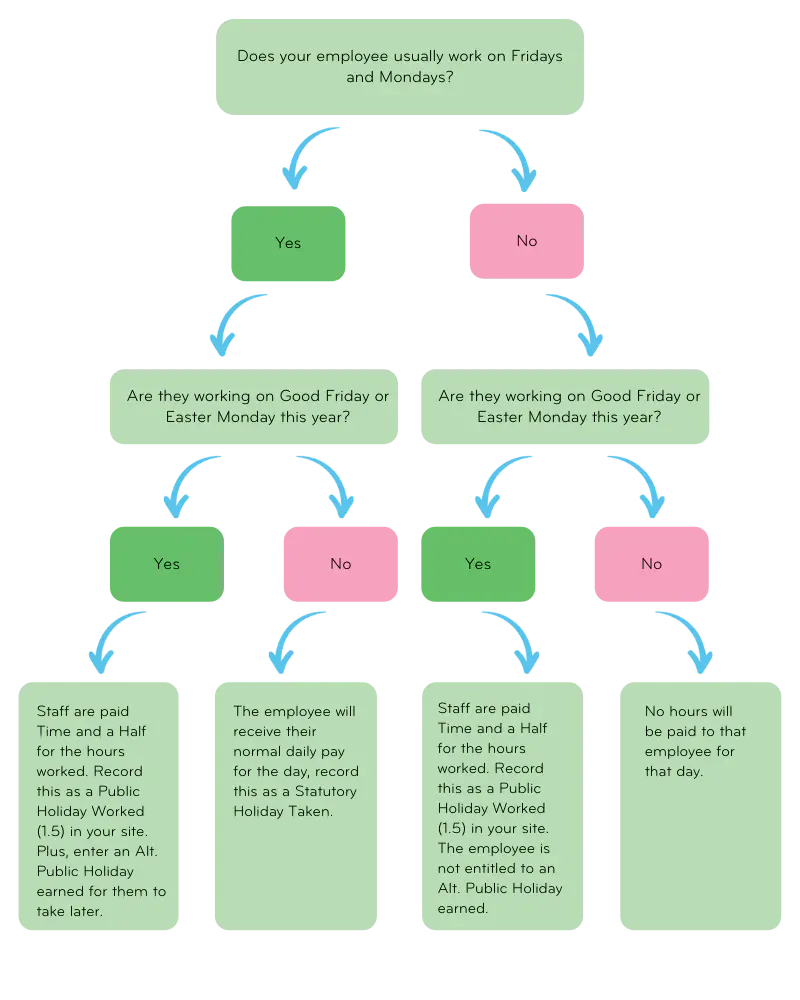

ANZAC Day this year (2025) is on Friday 25 April. Follow the flowchart below for your ANZAC Day payroll.

The public holiday for ANZAC Day is “mondayised” (moved to the following Monday) if it falls on a Saturday/Sunday and the employee would not normally have worked on that Saturday/Sunday. As ANZAC Day is on a Friday this year, if the employee would not usually work on a Friday, then no payment needs to be made for that day.

Paying an employee for a public holiday

Paying an employee who worked on a public holiday

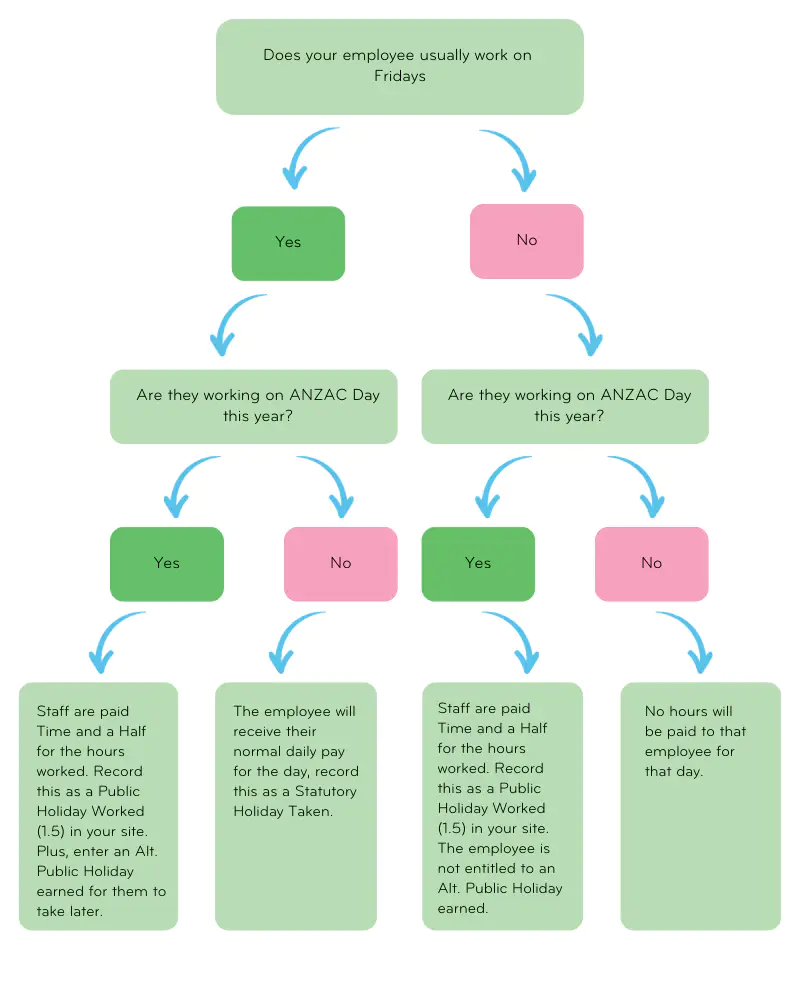

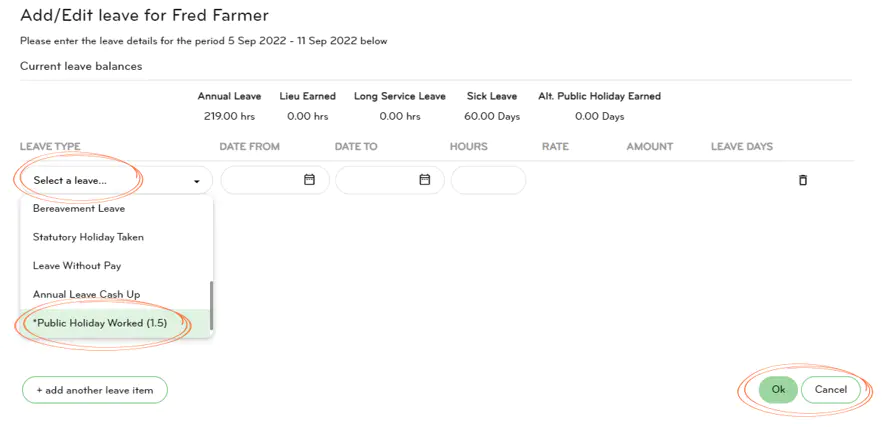

If you have an employee who worked on a public holiday, and it's their usual working day, they are entitled to time and a half and an Alt Public Holiday.

1. Go to Pay, then Run a pay.

2. Double click on the employee.

3. Click on Add leave item.

4. Under the Leave Type drop down, select the option Public Holiday Worked (1.5) and enter the dates and hours worked.

5. The employee is also entitled to an Alt Public Holiday Earned. Click on +Add Another Leave Item and select this leave type. Enter the dates and the amount of hours the employee would usually work in a day.

6. Click Ok and then continue entering your pays as normal.

Note: If it is not your employee's usual working day, they are only entitled to time and a half for the hours worked. You do not need to enter the Alt Public Holiday Earned.

If your employee is entitled to an Alt Public Holiday Earned, you must give them a full day regardless of how many hours they worked on the public holiday.

The Employment NZ website states:

The employee has the whole working day off work on the day they take an alternative holiday, regardless of how many hours they worked on the public holiday which gave them their entitlement to the alternative day.

For example, an employee normally works eight hours every Monday, but on a public holiday which falls on a Monday, they only worked for two hours. They get paid for the two hours worked at the rate of at least time and a half for working on the public holiday. They also get a whole working day off as an alternative holiday, on full pay. This means that if they take the alternative holiday on a day that they would otherwise have worked eight hours, they would be paid for the full eight hours for the alternative holiday.

Paying an employee who didn't work on a public holiday

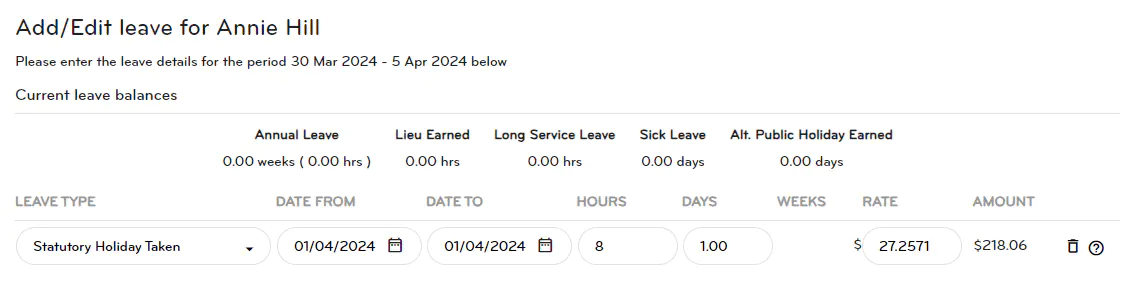

If it is the employee's usual working day, then they are entitled to be paid for the day. This is entered as Statutory Holiday Taken.

1. Go to Pay, then Run a pay.

2. Double click on the employee.

3. Click on Add leave item.

4. Under the Leave Type drop down, select the option Statutory Holiday Taken and enter the dates and hours.

5. Click Ok and then continue entering your pays as normal.

Public holiday worked option is not available in the payroll

If an employee does not have the Public Holiday Worked option when you add a leave item in the pay packet, it may not be turned on either at the Company Level or the Employee Level.

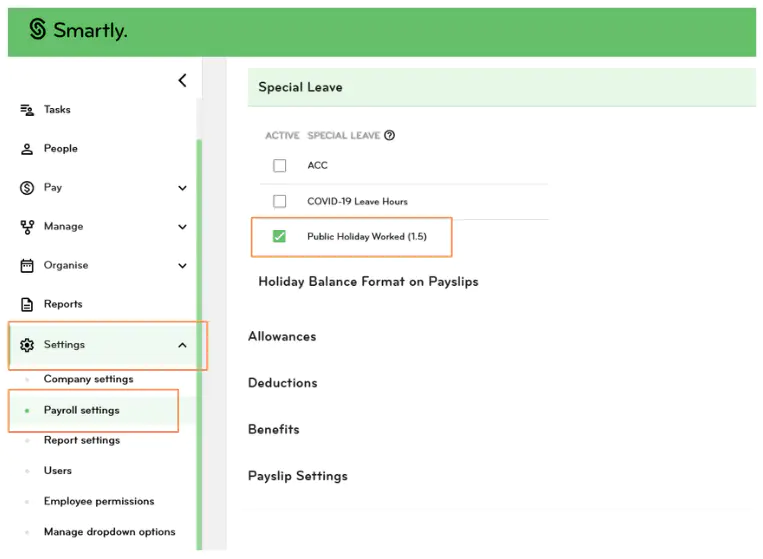

To activate it at the Company level, follow these steps:

1. Go to Settings, then Payroll settings

2. Click on Contract groups.

3. Select the contract group that the Public Holiday Worked (1.5) option should be applied to at the top of the screen, eg. Waged Employees.

4. Scroll down to the Special Leave section under Leave Entitlements, tick on Public Holiday Worked (1.5).

5. Click Save. Repeat for any other contract group that the Public Holiday Worked (1.5) option should apply to.

To activate it at Employee level, follow these steps:

6. Go to People

7. Click on the employee who did not have the Public Holiday Worked (1.5) option available .

9. Click the payments tab

10. In the Special leave area, tick the box next to Public Holiday Worked (1.5). The payment method will default to Normal Rate x 1.5. Click Save.

11. Go to Pay, then Run a pay, and then double click the employee’s name. The pay details screen for that employee will open.

12. Click Add leave item. The Public Holiday Worked (1.5) option will now be available in the drop down. There will be an asterisk beside it to show that it is a special leave type.

Timesheet entries on a public holiday

If your employees are on standard hours then any timesheet entries submitted on an otherwise working day would be recogised automatically as:

- Work done at time and half rate

Example: Joe's Employee payments screen shows that he works 8 hours per day, 4 days a week.

The system will assume Joe works Monday to Thursday. If Joe submits a timesheet of 8 hours for Monday 1 April 2024 (Easter Monday) , the system will change Joe's entry to:

- Public holiday worked (1.5) for 8 hours.

You would need to add in an Alt. Public Holiday Earned for Joe.

If Joe has submitted the timesheet in error, and he had the public holiday off instead, you can delete the auto corrected entry, and re-enter it as Statutory Holiday Taken.

Public holiday termination payment

If an employee is terminating right before a public holiday, you'll need to check if they have any earned leave (entitled leave under the Holidays Act).

If the employee was on paid annual leave, would their earned leave (using their normal /average hours per day) stretch across the public holiday? If it would, they are entitled to be paid for the public holiday (statutory leave taken).

Note: When Statutory leave is paid AFTER the termination date, it is classed as extra pay and would be taxed using the lump sum payment tax rates.

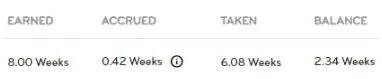

To check an employee's earned leave, follow the steps below.

1. Go to People and click into the employee.

2. Go to the leave tab

3. Subtract the Accrued leave from the Balance. This will give you the Earned balance.

2.34 Balance - 0.42 Accrued = 1.92 weeks available Earned leave.

Public holidays while on annual leave or leave without pay

Annual leave

If an employee is being paid annual leave when there is a public holiday, they're entitled to be paid for the public holiday instead of using their annual leave.

Leave without pay

If an employee is on leave without pay when there is a public holiday, they are not entitled to be paid for the public holiday. This is because the employee had no intention of working on that day.

However, if the employee is on leave without pay because they have no sick leave available, then they would be entitled to the public holiday.

Important: These situations aren't always straightforward, so if you're unsure, we suggest contacting MBIE on 0800 20 90 20.

Public holiday FAQs

Can I process my payroll on the day of the public holiday?

If you bank with ANZ, BNZ, ASB or Westpac and process your payroll on the day of the public holiday, your employees will get paid on the same day.

If you bank with a smaller bank or use our Auto Processing feature, please note the payroll will not be processed on the day of the public holiday.

My business is closed on Good Friday/ANZAC Day, so my employee can’t work. What are their entitlements?

Because your employee would have normally worked on these days, but can’t because your business is closed, they are entitled to be paid their normal daily pay. This should be recorded as a Statutory Holiday Taken in Smartly.

My employee has agreed to work on Easter Monday, but this is not their normal working day. What are their entitlements?

Your employee must be paid at least time and a half for the hours they work. This should be recorded as a Public Holiday Worked in Smartly. This employee is not entitled to receive an alternate public holiday.

My employee has agreed to work on Easter Monday, and this is their normal working day. What are their entitlements?

Your employee must be paid at least time and a half for the hours they work. This should be recorded as a Public Holiday Worked in Smartly. This employee is also entitled to receive an alternate public holiday.

Do public holiday entitlements change for casual employees?

No, casual employees have the same entitlements as permanent employees. For example, if your casual employee works on ANZAC Day, they're entitled to be paid at least time and a half. If this is a day they would normally work, they are also entitled to earn an Alt Public Holiday.

What are my contractor's public holiday entitlements?

Contractors are not entitled to be paid for public holidays by their employer, because they are deemed to be self-employed. Sometimes an employer may have a special arrangement with their contractor to pay them for public holidays.

My employee is going to be on annual leave over Easter weekend. What are their entitlements?

If your employee is on annual leave when there is a public holiday, they are entitled to be paid for the public holiday instead of taking annual leave.

What about Easter Sunday? What are my employees entitlements for this day?

Easter Sunday is not a public holiday. However, all shop employees have the right to refuse to work on Easter Sunday. If you require your employees to work on Easter Sunday, please ensure you are following the protocal as outlined in Easter Sunday rights and responsibilities on the Employment NZ website.

Employment NZ also states that:

If an employee works on Easter Sunday, they would generally be paid their normal pay rate for a Sunday unless they have agreed to a different rate with their employer.

If an employee doesn’t work on Easter Sunday because their workplace is closed due to shop trading hours restrictions, and they normally work on Sundays, then what they get paid for that day would depend on the terms and conditions of their employment agreement. Usually the employer has to provide work for the hours the employee is contracted for. If the employer doesn’t provide the employee with work (eg stocktaking while the shop is closed) they may have to pay the employee as if the employee had worked that day (unless the employment agreement says otherwise).

Can my employees work on ANZAC Day?

ANZAC Day is a restricted trading day. This means that shops can only open after 1pm. There are some exemptions, and we recommend getting in touch with MBIE if you have any questions.

If your business is not a shop, the restricted trading provisions on ANZAC Day don't apply.

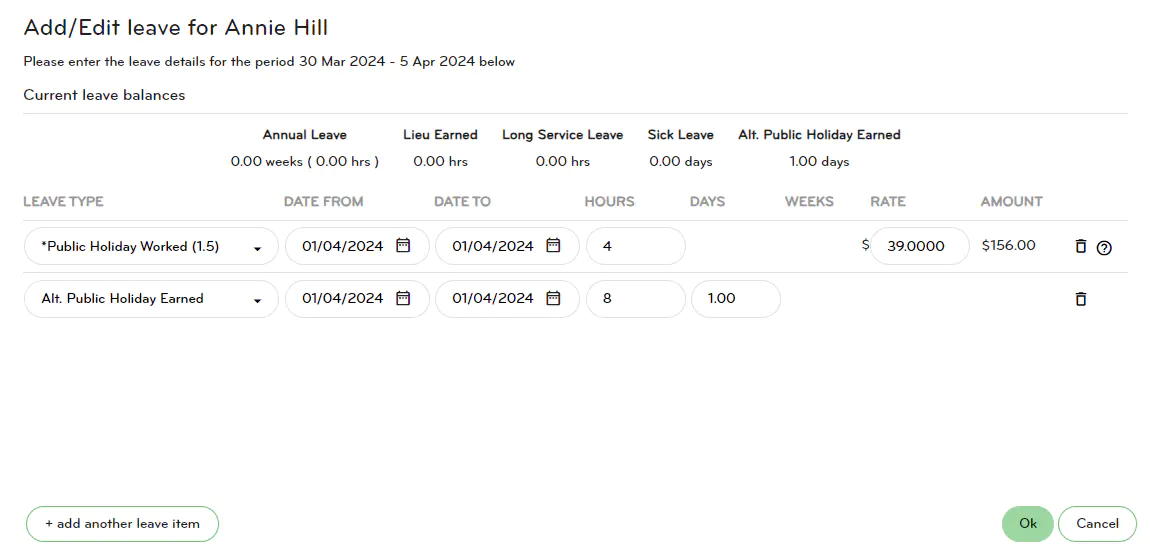

Employment NZ defines shop and goods as below: