It’s a great time to do a general tidy up, so you can make sure your employee’s information is up-to-date for the new financial year.

Here’s a quick checklist you can follow to ensure everything is in order:

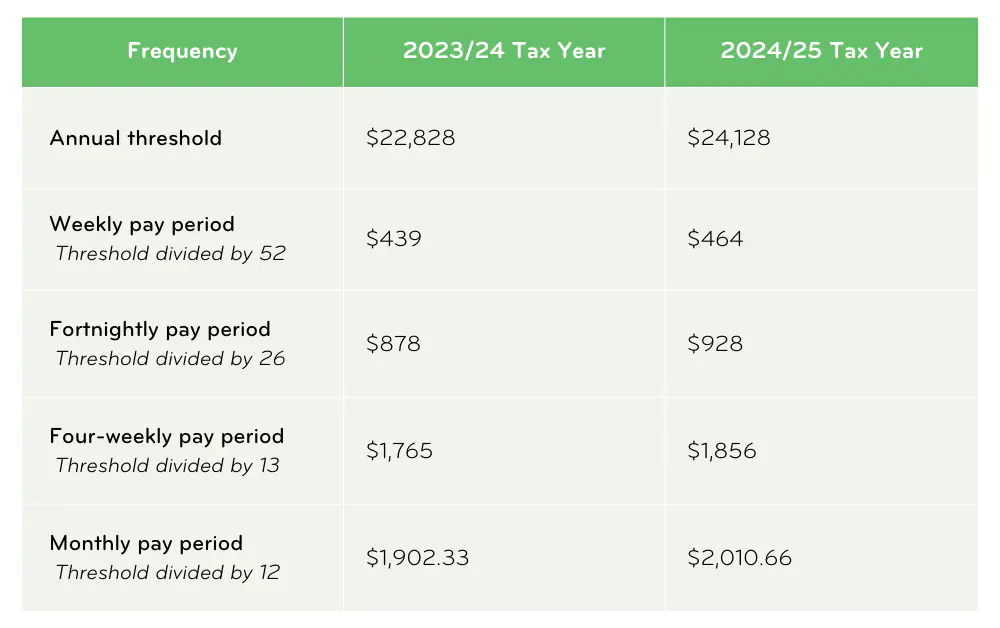

Check the pay rates for all your employees

Make sure their tax codes are correct

Check employee details, like their contact information and appointment information.

Check who has access to make changes within your payroll site

Review who has the authority to view and approve your pay runs

If you’re using Smartly for your payroll, your employee’s ESCT rates are calculated automatically – easy! We do still recommend thoroughly checking the earnings that Smartly estimates for you, so you can be sure they appear correct based on what you know about your employee’s earnings.

If you’re not using Smartly, you will need to verify the ESCT rate for each employee that will be used for the coming tax year. ESCT rates depend on the employee’s income and how long they have been working for you. Check out this page for more information about ESCT.