- COVID-19 business support payments

- COVID-19 leave

- Vaccination rules in the workplace

- COVID-19 terminations

- In a COVID-19 world how can going digital help?

The COVID-19 Support Payment payment is to help support ongoing Kiwi businesses or organisations who have experienced a 40% or more drop in revenue due to certain circumstances.

The applications for this payment have closed on 5 May 2022.

There are 3 affected revenue periods in which you can apply for this payment. For more information on the scheme and how to apply see Inland Revenue.

.jpg/_jcr_content/renditions/optimized.webp)

There are many reasons why an employee may need to take COVID-19 related leave when they are not yet positive with COVID-19. It’s important to know the rules around what your employee is entitled to when they are sick, or someone they have been in close contact with tests positive for COVID-19.

The COVID-19 Leave Support Scheme is available for employers, including self-employed people, to help pay your employees who have been advised to self-isolate because of COVID-19.

This means your employees:

Affected groups mean employees who:

The COVID-19 Leave Support Scheme is paid at the rate of:

As an employer, you must meet a certain eligibility criteria to apply for this scheme and your employee also must meet a certain health criteria. You can find more info here on the Work and Income website.

For the full list of employer obligations, please refer to the COVID-19 Leave Support Scheme Declaration here.

If you're unsure about how to approach your situation, we recommend getting in touch with Work and Income. You can find out how to apply for the COVID-19 Leave Support Scheme here.

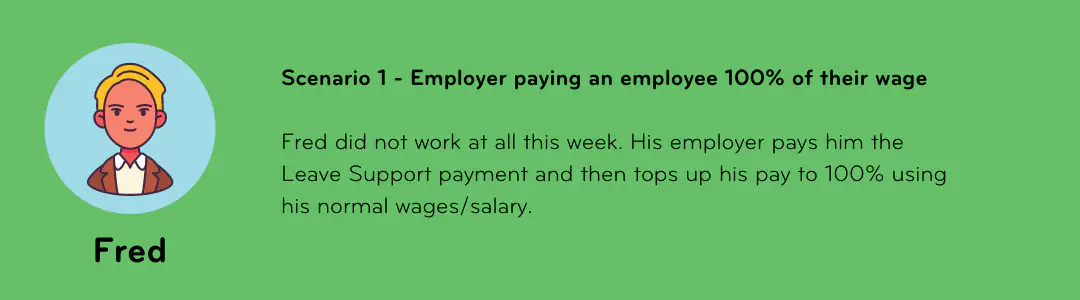

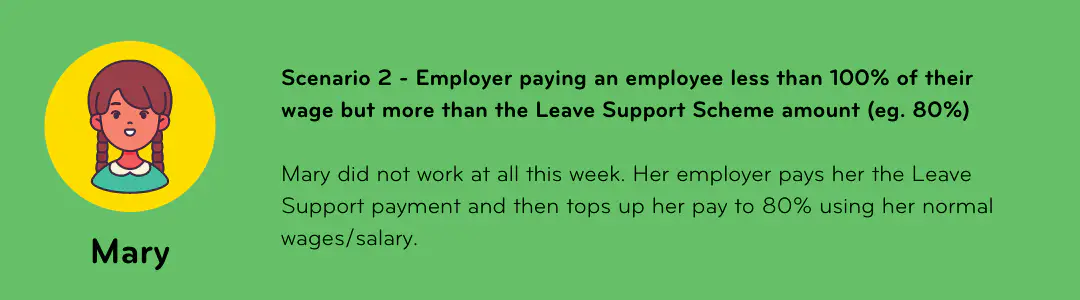

Scenarios 1-3 are based on an hourly rate of $25 per hour, or $1000 per week where the employee would normally work 8 hours a day, 40 hours per week.

Scenarios 1-3 are based on an hourly rate of $25 per hour, or $1000 per week where the employee would normally work 8 hours a day, 40 hours per week.

How to record in Smartly

How to record in Smartly

How to record in Smartly

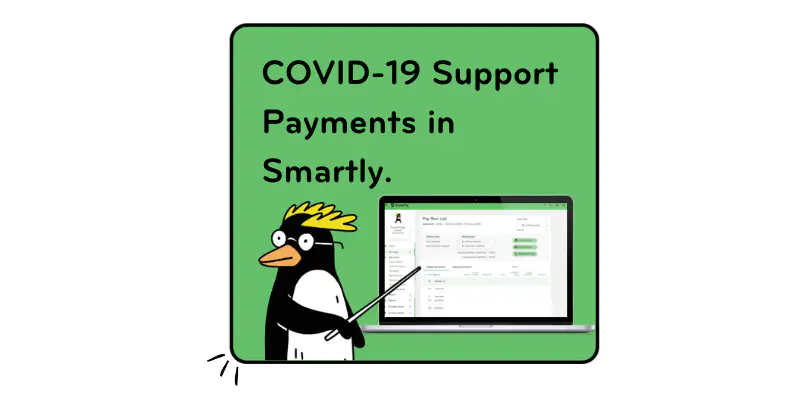

For more common employee scenarios and how to enter them into Smartly read the COVID-19 Support Payments Guide.

COVID-19 Short-Term Absence Payment

The Short-Term Absence Payment is available to help pay employees who are waiting for a test result. It’s also available to eligible self-employed workers.

To be eligible, your employee must:

Eligible employers can apply to receive a one-off payment of $359.00 for each eligible employee in any 30-day period.

.png/_jcr_content/renditions/optimized.webp)

It is recommended you keep a record of the pay run that uses the COVID-19 Leave Support Scheme Payment in Smartly. Smartly has COVID-19 pay components to help with this:

Special Leave Type: COVID-19 Leave Hours

This is an unpaid leave type to record any hours of absence for your employee during their COVID-19 leave period, so they can continue accruing annual leave on any hours that they would normally be expected to work.

Allowance: COVID-19 Leave Payment

This allows you to keep track of any COVID-19 support payments made to employees as a taxable allowance.

You can find easy-to-follow steps in the Smartly COVID-19 Support Payments Guide to process the payment in Smartly and some common employee scenarios.

Recent changes to the vaccination mandate mean that vaccination requirements for some employees no longer apply and businesses are not required to enforce the vaccine pass regime.

As of 4 April 2022, Government vaccination mandates will no longer apply for:

Government vaccination mandates continue to apply for:

If a workplace still has a Government vaccination mandate, it is up to the employer to implement the controls and requirements based on a health and safety risk assessment.

If your business requires employees to be vaccinated subject to the Government’s vaccination mandate, the workplace must keep a record with the following information:

Employees’ vaccination record is personal information that must be used in line with the Privacy Act 2020. This includes how this information is collected, used, maintained and disposed of. The key points are:

Find more information on vaccination records here.

If your business is subject to the Government’s vaccination mandate or requires a vaccination following a risk assessment process, as an employer, you may terminate an employee if they do not comply with the business’ vaccination requirements. This is provided all other reasonable alternatives that would allow the employee to keep working have been exhausted and a minimum four-week paid notice period is provided.

This four week notice period only applies where the employment agreement does not contain a termination notice period, or the notice period is shorter than four weeks. If an employee has a notice period that is longer than four weeks in their employment agreement, that will continue to apply.

Other aspects of employment law will not change, including that:

The termination notice is cancelled if an employee gets vaccinated during their notice period, unless this would unreasonably disrupt their employer’s business. This may include where a small business has hired a replacement employee and there is no other work available in the business.

If an employee loses their job because they decide not to get the COVID-19 vaccination, there may also be eligible for support from Work and Income.

You can find more information on COVID-19 vaccination requirements in the workplace here on the Employment New Zealand website.

.png/_jcr_content/renditions/optimized.webp)

The notice period is entered in Smartly as ordinary hours over the 4 weeks based on their usual pay frequency. It is not paid as a lump sum payment or taxed as Extra Pay.

As the vaccination mandate has been dropped, it raises questions as to whether employees who lost their job due to the vaccination mandate can get their job back.

Simply put, it is up to the employer. Termination due to the Government or business imposed mandate is a decision that still stands and a former employee does not have an automatic right to get their old job back or any other role with their previous employer.

There is also no obligation for a former employee to accept a job offer from their previous employer.

For any further questions about this please refer to the Employment New Zealand website.

As we adapt our businesses to a new flexible and COVID-19 friendly world, it’s important to plan for the pain-points that may arise and most importantly, how you can overcome them. If your business still uses manual or paper processes, going digital is crucial when implementing flexible or hybrid working.

Going digital is now what allows us to be able to work from home or have hybrid home/on-site working. You may have already moved your files and teams online, but your administration tasks like leave management, timesheets and job costing can also be transferred online to make it easier to track across the whole business.

It's important for your team to be able to stay connected when in different locations as well as having them able to access to timesheets and other applications on their devices especially when they can’t come into the workplace. Apps such as the Smartly employee app make it easy for employees to access payslips, timesheets and leave all in one place whilst on the go. To take a small step going digital, you can check out 5 benefits of moving your timesheets to digital.

At a time where late notice leave and varying hours can be frequent, it’s important to stay on top of them. Often simple employee submissions like leave and timesheets can all be sorted in one place (or even in a calendar view) in your payroll or HR management software. Software like Smartly allows you to track your employees’ COVID-19 leave and other payments when processing pay runs. This allows for easy report generation when required for auditing purposes plus, it keeps all your COVID-19 payroll related information in one place.

Watch our COVID-19 Support Payments webinar to find out the best practices and tips on recording your company’s COVID-19 leave and payments in Smartly.

Keeping up with the constant changes of COVID-19 laws, rules, regulations and recommendations for the workplace is tough work. These changes can have a significant impact on your employees so it’s crucial to stay in the know. That’s why we’re here to help you stay on top of it all.

Smartly gives you industry and legislation updates to your inbox monthly so you can keep your team informed of any changes that are coming up. Keeping them in the know of any changes that will affect them and giving them access to their own pay information makes it easier for everyone!

Smartly can also help you stay compliant with leave, tax rates and the rest plus, we the Smartly product is certified with the information security standard; ISO27001.

If you want to learn more about how your day to day tasks can be made simpler, you can chat to us to get some insight on how payroll software could benefit your business. Smartly can make the complex tasks seem simple including payroll, timesheets, leave and more! Smartly takes care of most of the faffing, so you can focus on the important stuff.