NZ personal income tax rates as at 1 April 2022.

NZ personal income tax rates as at 1 April 2022.

The rate you deduct employee contributions from their gross pay is the following:

Your employee tells you which rate to use on their KiwiSaver deduction form – KS2 (available on the IRD website).

If an employee is using KiwiSaver and does not choose a contribution rate, use the default rate of 3%.

Employers must contribute a minimum of 3% of their employee’s gross salary or wages to their KiwiSaver. Employers must make these payments every payday. This is in addition to the employee’s gross salary or wages.

A tax on any cash contribution an employer makes to a superannuation fund for the benefit of an employee. For example, employer contributions to an employee's KiwiSaver.

The employee ESCT rates are:

There are 2 ways to deduct ESCT, you can either:

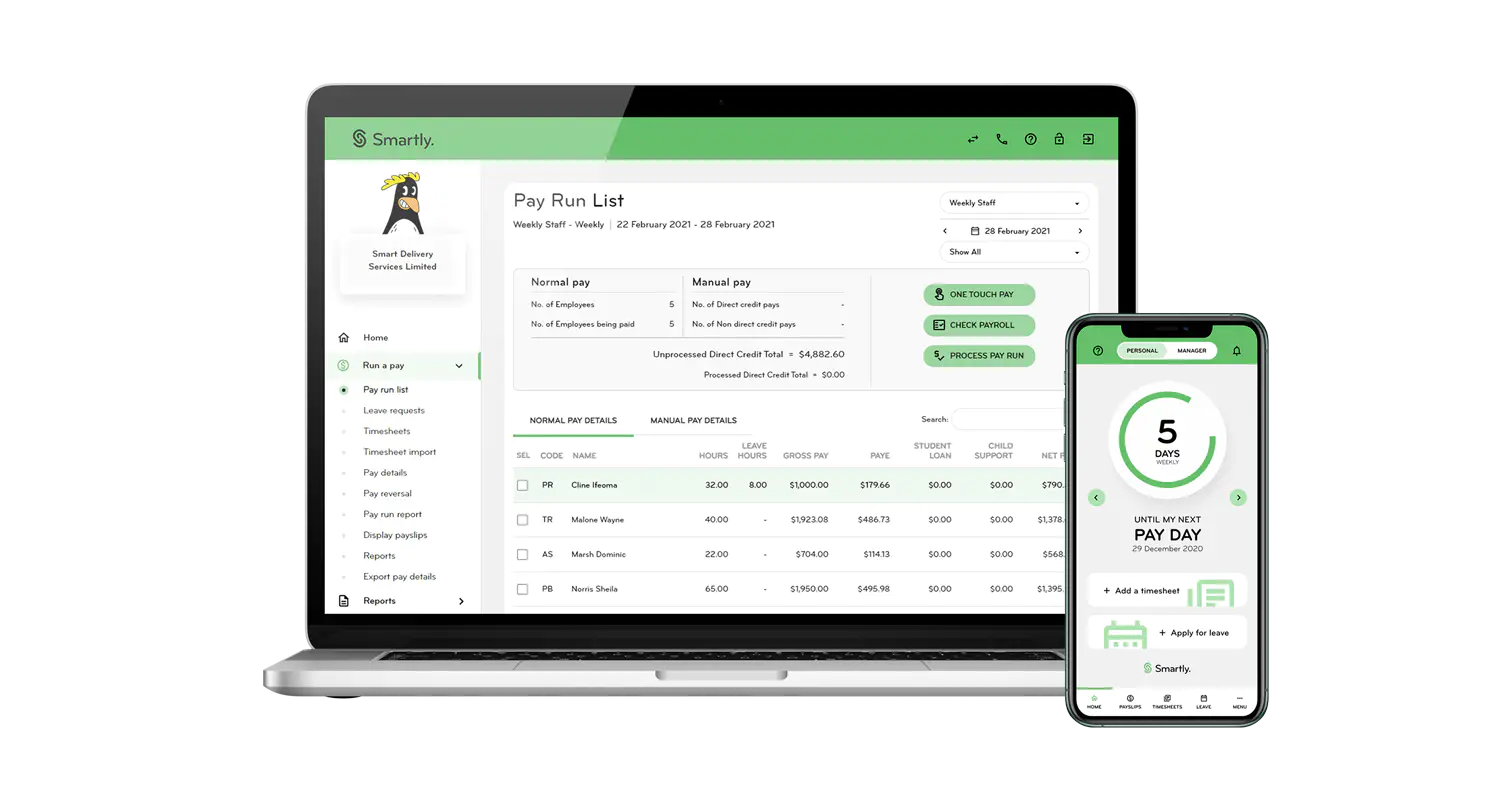

Payroll information is filed directly to IRD via payroll software (like Smartly) or online. Employee’s earnings information is sent to IRD, to make sure that tax is calculated correctly and shows correctly in the myIR portal.

You need to do this every payday. Make sure new employees are setup using the IR330 (tax code) and KS2 (KiwiSaver form). Electronic filing needs to be completed within 2 working days of each pay.

PAYE payments are due to the IRD by the 20th of each following month. If you’re a large employer it’s by 20th of the same month and by 5th of the following month.

A large employer is a business with PAYE and ESCT more than $500,000 per year.

Student loan repayments need to be deducted for employees with a tax code ending in SL. Repayments are deducted at 12 cents in the dollar for every dollar the employee earns over the threshold for tax codes M SL and ME SL (see table below).

For other tax codes ending in SL, deductions are made for every dollar the employee earns.

If child support payments need to be made, make sure they are deducted correctly. IRD will let you know when and how much to deduct.

The current minimum wage in New Zealand is $21.20 per hour and the minimum rate for training and starting out is $16.96. Ensure all employees aged 16 years or over are paid at least this.

Everyone is entitled to 4 weeks annual leave per year. Currently, this becomes available after 12 months of continuous employment, but an employer can make this available in advance.

Leave balance should be held in weeks, rather than hours.

A maximum of one week (out of the employee’s 4-weeks minimum entitlement) can be cashed out for each entitlement year.

A parent is entitled to 26 weeks of paid leave and a further 26 weeks of unpaid leave subject to relevant eligibility criteria. For further information, please check out our parental leave blog.

The amount an employee is paid during parental leave is equal to their ordinary weekly pay or average weekly income up to $621.76 a week before tax for the 1 July 2021 to 30 June 2022 period. IRD makes this payment directly.

Employees continue to accrue annual leave while on parental leave.

Employment New Zealand have handy resources to help with public holidays and mondayisation.

An employee’s final pay must include:

We've also turned this blog into a cheat sheet for you to download.

Download it here: Smartly Payroll Cheat Sheet

Payroll legislation, the Holidays Act, leave entitlements and more, it’s a lot to get your head around. Our automated and simple to use payroll software can sort this all for you. Learn about Smartly and sign up today.

Please note the information outlined in this payroll blog is for the current tax year. 1 April 2022 -31 March 2023.