You probably have a million things to do as a business owner. If you’re like most businesses, payroll is probably the most important and the most time-consuming!

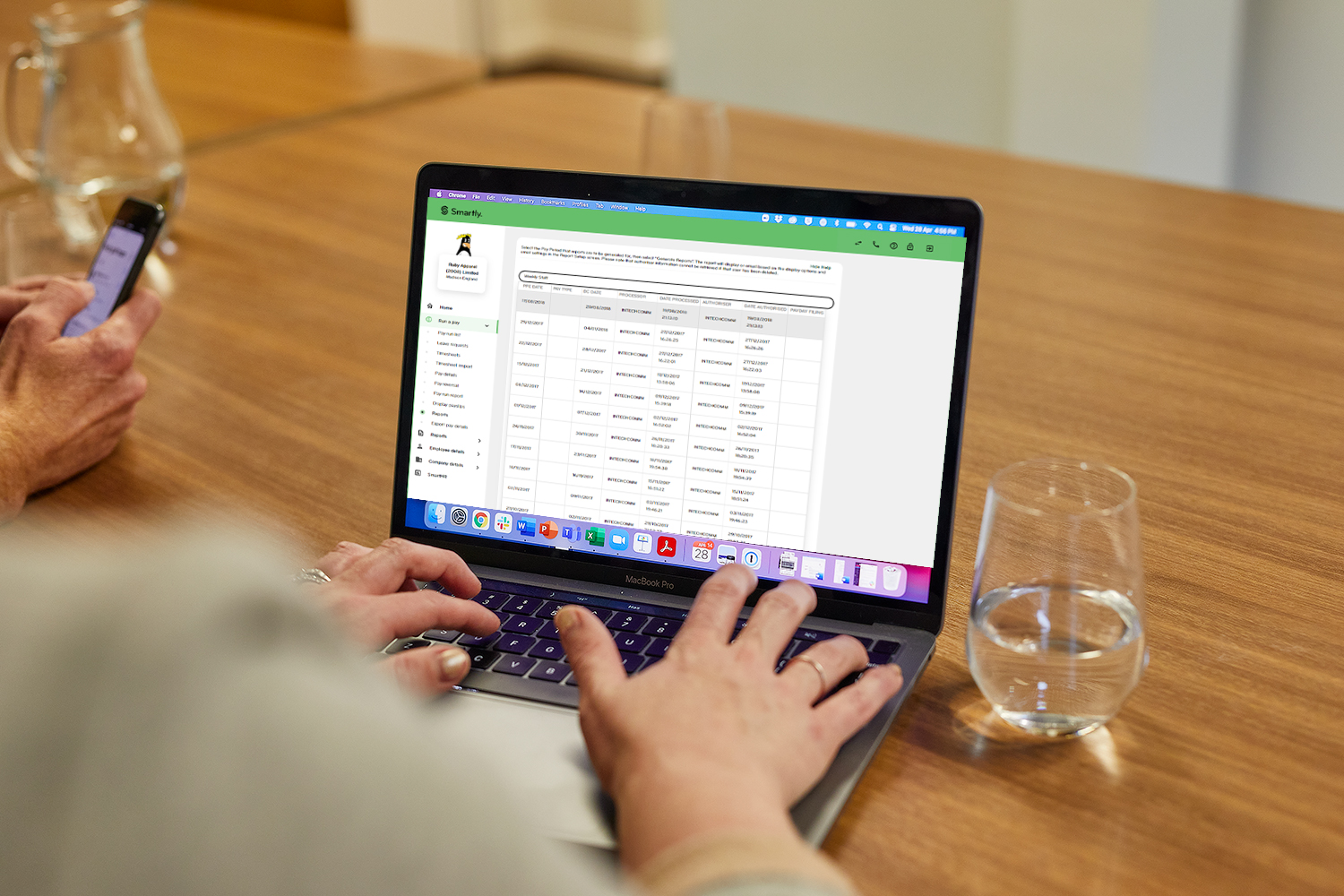

Payroll automation can fix that. Also known as automatic payroll software, payroll automation can save you time, money, and stress when it comes to paying your staff. Say goodbye to manual calculations and spreadsheets.

If you’re looking to simplify your payroll system, and maximize profits with payroll processing, this article will show you what payroll automation is (and why you need it), as well as tips that will save you time when you start automating payroll.