Personal income tax threshold changes

From 31 July 2024, the personal income tax threshold will be increased:

We have updated the Smartly system so any pays you process on or after 31 July 2024 will have the new tax threshold applied. Any pays you process before 31 July 2024 will have the existing tax threshold applied.

Any extra pays (lump sum payments) will be calculated as they always have been using the lum sum payment tax calculation. This is to lessen the chance of employees getting a tax bill at the end of the tax year.

End of 2025 financial year square up

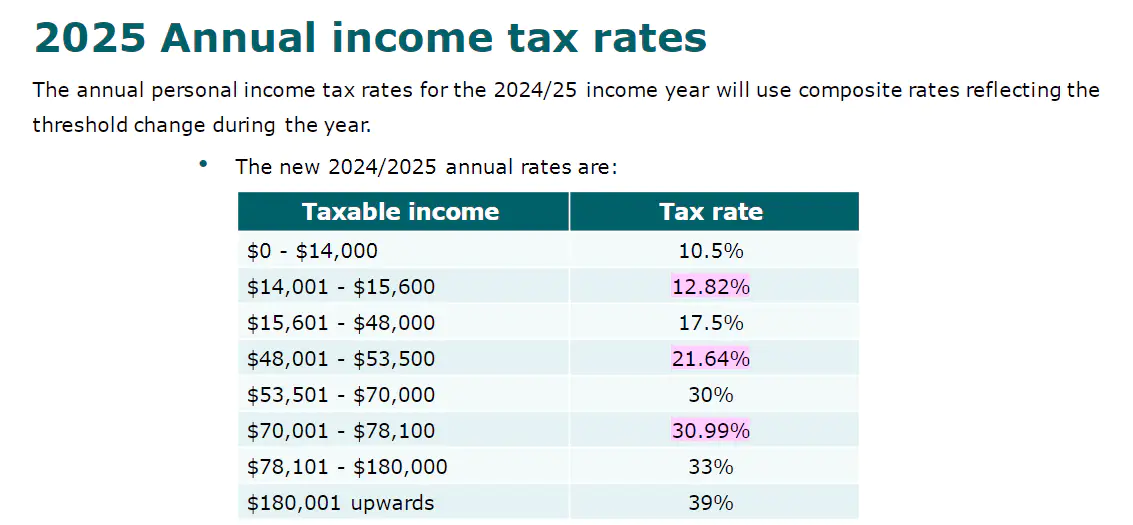

With one tax threshold from 1 April 2024 - 30 July 2024, and another threshold from 31 July 2024 - 31 March 2025, IRD will apply a composite tax rate for earnings in between the two tax thresholds:

The composite rates will happen on IRD's end when they do the end of year tax assessments.