Leave in weeks

The Holidays Act 2003 is a very complex piece of legislation and one of the significant issues with leave calculations stems from Section 16 which states:

“After the end of each completed 12 months of continuous employment, an employee is entitled to not less than 4 weeks’ paid annual holidays.”

Unfortunately, most payroll systems record annual leave in hours, and what starts out as simple math can quickly morph into something far more complicated. The easiest way to demonstrate compliance is to hold leave balances in the time units stated in the legislation – i.e. weeks.

Although it’s fine to hold your leave balance in hours, those hours must be clearly equivalent to the employee’s 4-week entitlement. They must also genuinely reflect what constitutes a week for the employee at the time the leave is taken, not when earned – and that’s where things get tricky. Most affected are employers with staff that work highly variable hours and days or who have changes in work patterns.

To make it easier to remain compliant with the Act, Smartly now holds leave balances in weeks and we've been transitioning customers over to this calculation method.

Holding leave in weeks:

- Removes the need to recalculate balances when work patterns change

- Demonstrates the principle that entitlements can only be determined in relation to the work pattern that exists at the time leave is taken

- Makes it clear that employees receive their correct entitlements

Leave in weeks guide for your employees

For frequently asked questions your employees may ask about leave in weeks and an example of leave balances, please refer to our Leave in weeks guide for employees article or download the pdf here.

Fluctuating leave balances

For employees who work highly variable hours, it is likely their leave balance in hours will fluctuate up or down each period based on their rolling average hours per week and the averaging period selected. This is why their leave balance in hours is indicative only.

However, what is important to understand is that their balance in weeks will always move up at a constant rate of 0.0767 weeks per week, ensuring they receive exactly 4 weeks of annual leave entitlement on their anniversary.

For a detailed example of fluctuating leave balances, please refer to our Leave in weeks guide for employees article or download the pdf here.

Averaging period for employees with no standard hours

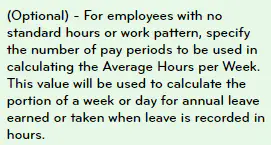

You must determine an averaging period for your employees who have no standard hours so that the system can make a reliable estimate of what a “week” is for the employee as at now. You then need to enter this figure in the Employee Payments screen. The system will default to 4 if it is left blank.

For employees with no regular hours or days of work, there can be difficulty in determining what a “week” is. MBIE are critical of employers that default to an averaging approach before trying to establish a pattern of work. Therefore, you should first give careful consideration before concluding that an employee’s working hours and days has no predictable work pattern.

If it is genuinely not possible to identify their work pattern, then both you and your employee may agree to base their portion of annual holidays entitlement on their average week, with reference to the exact number of pay periods that should be used to calculate this.

For example, you may agree with your employee that the last 4 weeks of hours and days will determine what an average week represents for them at any given time. Every business is different, so for some employees 4 weeks may be suitable, but for others an average week may need to be calculated over a longer period.

When migrating to Annual Leave in Weeks, the average hours per week determined by this agreed averaging period, will be used to convert employee’s current hours balance into weeks. If no agreement already exists with the employee regarding the averaging period to be used, then we recommend you discuss this and reach an agreement with your employee.

MBIE warn against employers having a “set and forget” approach to payroll as this carries a high risk of non-compliance. Therefore, it is essential that you continually monitor changes in your employees’ work patterns and adjust annual holiday balances accordingly.