Allowances

Bulk add allowances

Whether you're assigning an allowance to one employee, or to your whole team, you can use the Bulk assign an allowance feature. It'll take just a few minutes, and you'll be good to go.

You can use this option for all allowances, including Regular bonuses.

You can also bulk assign allowances to multiple employees from the Run a pay screen.

To add an allowance for one or more employees, follow the steps below:

1. Hover over Company details and then select Pay components.

2. Under the Allowance section, click Bulk assign an allowance.

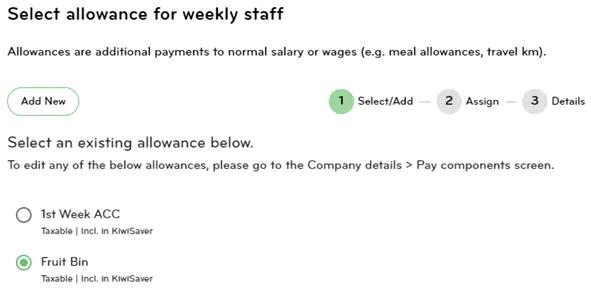

3. Choose one of the existing allowances listed on the screen, or if you’d like to add a new allowance, click Add New.

4. Once you’ve chosen the allowance, click Next.

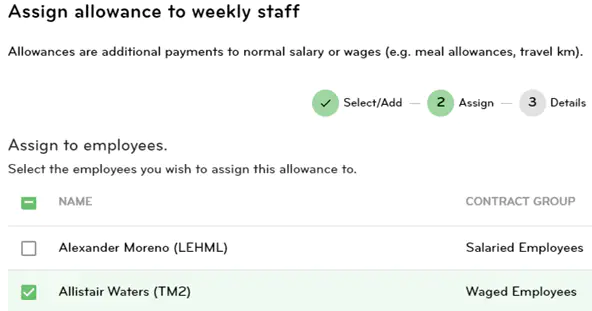

5. Tick the employees you’d like to apply the allowance to, or you can easily select all by clicking the tick box next to ‘Name'. Once you’ve selected the employees, click Next.

6. Enter the Quantity and/or Rate if needed for each employee, then click Next.

Note: Making this change will cause any unprocessed pays for the employee/s being updated to be cleared.

To bulk assign allowances from the Run a pay screen, follow the steps below and then follow from step 3 above:

1. Go to Run a pay

2. Click on Add pay component at the top of the screen, and select Allowance.

Allowances report

This report shows what allowances were paid to employees over one or more pay periods

1. Go to Reports.

2. Click on Report generator.

3. Select Payroll as the report category.

4. Select the Allowances report.

5. Choose which allowance, pay group, and department you would like to include. You can choose more than one if applicable.

6. Choose the date range or the period end date you want to run the report for.

7. Select Display.

Taxable and non-taxable allowances

Non-taxable allowances are generally reimbursements for things that the employee is out of pocket for (can include mileage, travel, tools etc. with certain criteria)

If you're unsure if an allowance is taxable or not, it's best to get in touch with IRD.

Taxable allowances are included in PAYE calculations, not taxed at lump sum rates. They are also always included in leave earnings.

Remove an allowance from an employee

1. Go to Employee details.

2. Highlight the employee, then go to Employee payments.

3. Scroll down to Allowances and untick the allowance you want to remove, and click Save.

4. The allowance will be removed from the employees pay details. If you've already entered hours for the employee, you will need to clear the pay and enter the hours again.