- Watch out for upcoming changes to legislation

- Processing your final pay run

- Cashing up annual leave

- Reports you might need

- COVID-19 financial support for Kiwi businesses

- Updating and reviewing your payroll

- EOFY resolution

.png)

Starting from 1 April 2022, the minimum wage is increasing from $20.00 to $21.20 per hour, starting-out and training minimum wage will also increase from $16.00 to $16.96 per hour.

You need to make sure this is accounted for and ready to go as part of your payroll. If you’re using Smartly, it’s pretty straight-forward to update pay rates, and we’ll prompt you along the way if you forget.

What you need to do:

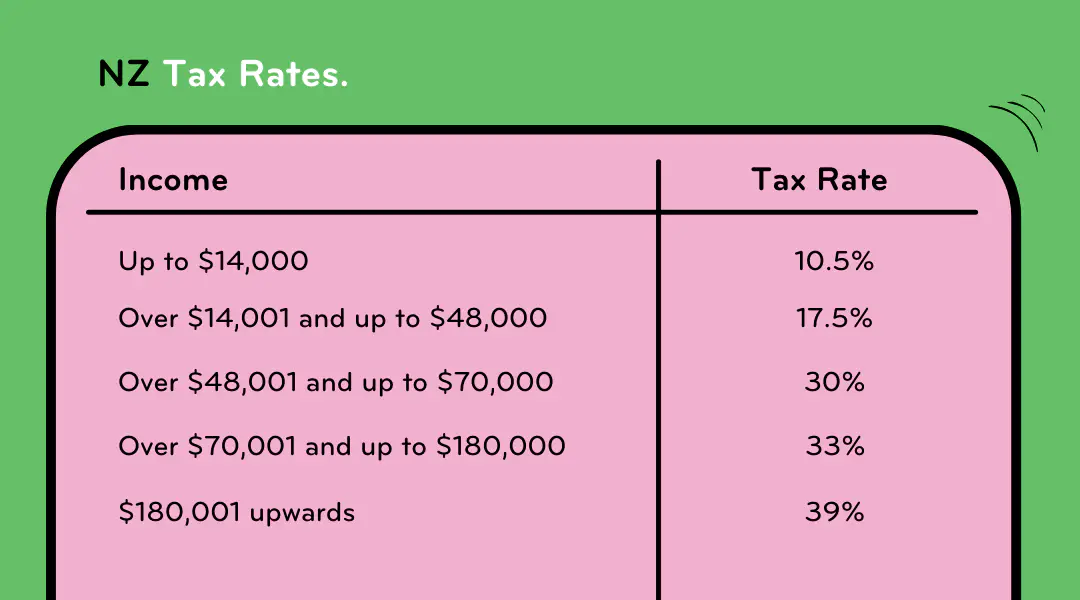

The tax rates will stay the same from the 2020/21 financial year as below, but there are some other tax rate changes for ACC earners levy and student loans as of 1 April 2022.

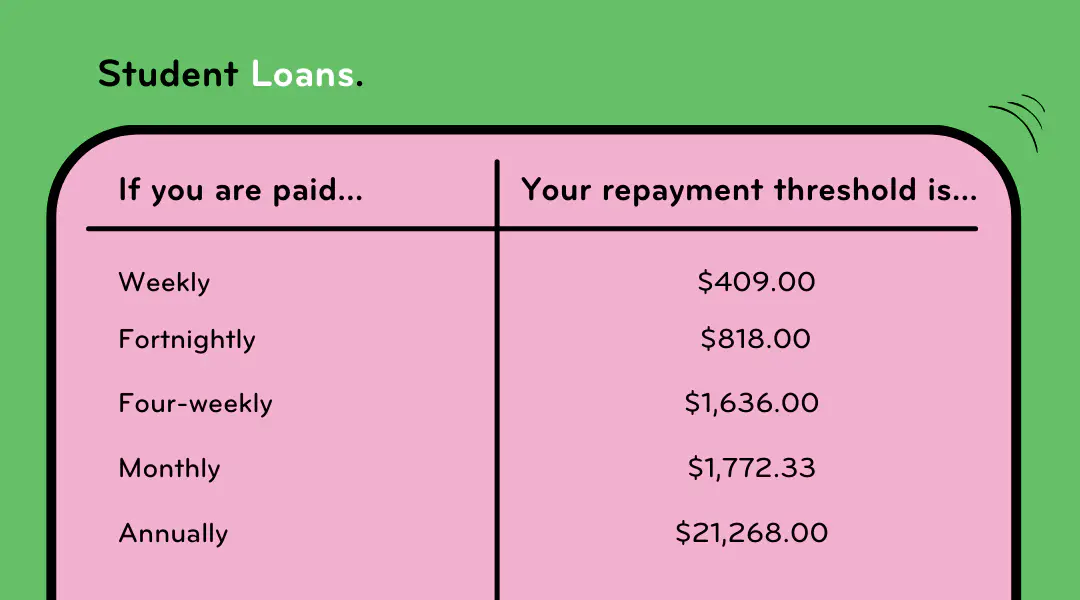

The annual student loan repayment threshold will increase to $21,268. This is the income level above which student loan deductions will be taken. This is broken down by pay period threshold amounts in the following table:

Using Smartly? We will automatically switch to the updated tax and student loan rates. Learn more about tax rates in New Zealand.

Since 24 July 2021, minimum sick leave entitlements have been increased from five to 10 days.

Remember that if these changes haven’t already affected your employees, they will roll out gradually.

If you’re a Smartly customer, we’ll sort everything for you in the background. But also check out our Changes to sick leave entitlements blog for more information.

It’s simple, your final pay for the 2021/22 financial year is the same process as how you’ve been doing it usually. Just make sure it’s completed on time to have the pay run in the correct financial year. You can also use this final pay run to check your employees’ payslips and pay data is correct as well as ensuring it’s in the right period for your reporting.

When using Smartly this is all sorted for you and you can pull any reports as and when needed. Easy right?

End of financial year is a common time for staff to cash up annual leave.

Here’s a couple of things to remember:

This report is an employee’s data as a certificate of earnings that can be used at the end of the tax year. It’s likely an accountant will be interested, so ask them about the specifics.

To get this report in Smartly, follow these steps:

This report shows all earned and taken leave, including any adjustments that have been made. The amount shown for annual leave paid in advance is based on the weeks value calculated at the time of the payment. This report is often used as part of the end of financial year reporting. It also allows employers to work out which annual leave is deductible for the financial year.

To get this report in Smartly, follow these steps:

For a full breakdown of all the different reports that are available in Smartly, check out our Reporting Guide. Or, if you just want to watch a quick demo see our Reporting video.

Throughout 2021 COVID-19 support payments were paid out to many Kiwi businesses. If you received a wage subsidy payment you do not get a tax deduction for these COVID-19 subsidies paid from the Government. So, you’ll need to separate this out for the financial year and in any reporting you do. In Smartly you can do this by selecting ‘Payroll’ then ‘Allowances’ and then ‘COVID-19 Leave Payment’ in the reporting section.

The COVID-19 wage subsidy schemes have now closed, but for current financial support for businesses, you can check out business.govt.nz.

It’s a great time to do a general tidy up, so you get it sorted for the year.

Employers need to work out the ESCT rate for each employee. ESCT rates depend on the employee’s income. If an employee’s salary or wage changes throughout the year, you won’t need to change the ESCT rate until the end of the tax year. This is something to be aware of, but for Smartly customers it’s all dealt with behind the scenes. Phew!

It’s not always a straight forward situation so we suggest contacting Employment NZ on 0800 20 90 20 if you’re unsure about anything to do with your team. IRD are also there to help when it comes to any tax-related queries.

Start the new financial year fresh with Smartly’s digital payroll software to take care of the faffing so you can focus on what’s more important – running your business.

Payroll can be complex, we’re here to help make it simple. Smartly takes care of most of the end of financial year wrap up, but if there’s something you want to talk through our support team are always there to help. We offer free support and training to our customers. End of year payroll is made simple with Smartly.