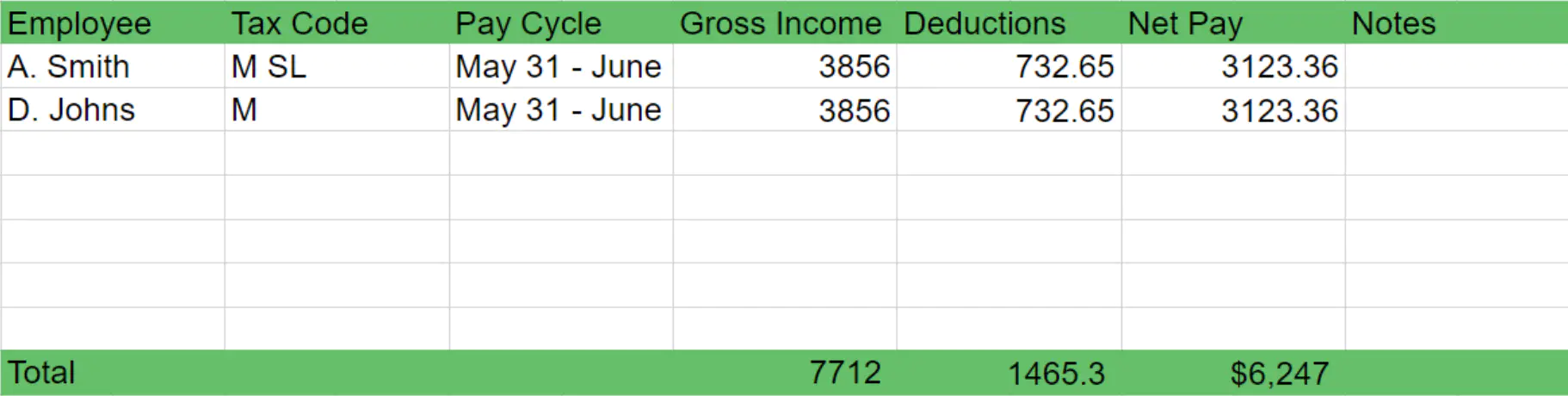

Payroll ledgers, also known as a wage book, are a record of what you have paid to your employees. It is basically a run down of everything going out in each pay cycle.

This guide will take you through what payroll ledgers are for, the benefits of keeping track with a payroll ledger, how to use one in your own business, and a payroll ledger example to get you started.